Close Menu

February 22, 2020

I see and hear from people around my age – in their 20s and 30s – really struggling to make decisions in their lives.

They want to save, but they want to enjoy life. They want to get married and have kids, but they want to work less and have more free time.

These are decisions that a lot of us are facing. And unless you’re a weirdo like me, who realised at age 19 that freedom was my #1 goal, it’s possible you struggle with this too.

So today, I’ll try to pry apart this frustrating web of trade-offs and see what we can do about it.

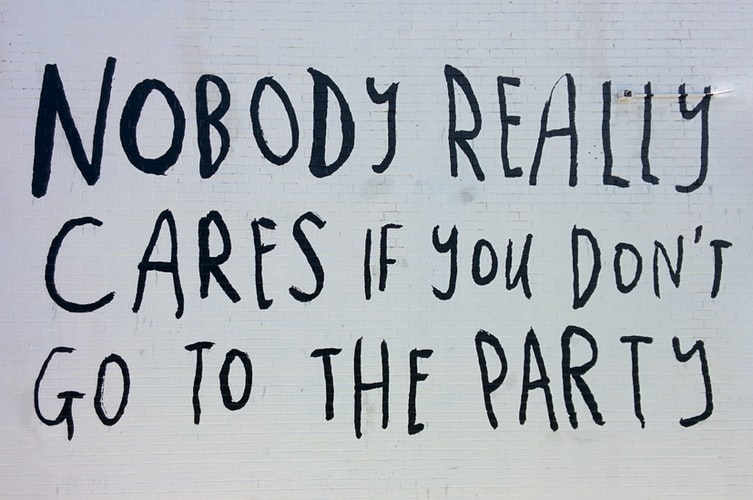

I’m calling this fear-of-missing-out (FOMO), the ‘Millennial Mindset’. That’s because it seems to be mostly young people who struggle with wanting it all.

It could just be our lack of life experience, or that our identities are not as well solidified yet. Maybe it’s being constantly exposed to what others are doing through social media.

Whatever the reason, the average Millennial’s default setting seems to be, “I want to do everything/go everywhere/meet everyone/buy everything/experience all there is.” In short, we seem to have a hard time choosing between things.

On the other hand, the older folks have already realised something important: everything cannot be equally important, so it’s our job in life to prioritise and choose what matters.

Quite often, comparing ourselves to others is where the pain-point begins. Where others are progressing to their goals faster than us, or are seemingly enjoying more good-times than we’re having.

The main point here is, you can’t have it all. You have to choose. And the frustrating part is some of the goals I listed earlier are in opposition to each other. If we try and achieve both at the same time, we don’t really get the full benefits of either. Damn!

But rather than moan about it like the rest of the internet, we look for solutions. What can we do?

It almost sounds too simple. But almost nobody consciously does it. Many of us just cruise through life, wandering in whichever direction takes our fancy at the time, hoping things turn out for the best.

But it’s your life we’re talking about. This shit is important!

So, sit down and think about it. Really think. What’s most important to you? Is it starting a family? Is it having a big wedding? Travelling the world? Being financially independent? Building your own business?

It doesn’t matter what it is. What matters is you get very clear with yourself about what you’re choosing to focus time, energy and money on, and why.

It’s important to remember that everyone’s situation and path to financial freedom is different. So try not to have expectations around what your journey should be like. Also, it’s your life, nobody else’s, so try to ignore the influence of others and decide on your own priorities. Do what makes sense for you.

Of course, you’ll have multiple things you want to do, experience and accomplish. That’s healthy. But deciding which things sit at the top of your priority list is a must.

After this, everything will start becoming easier. Because when you feel scattered and frustrated, you can revisit your priority list. And this helps you refocus, or allows you to make changes, reorganise your priorities, and steer your life’s ship in a new direction.

Maybe you’ll realise that reaching financial independence is not actually your top priority. And that might actually be a good thing, for your sanity at least!

If you’ve concluded that FI is essentially your top priority at this point in your life, then knowing what to do is easy.

You can comfortably optimise the crap out of your spending, while still enjoying your day-to-day life. And you’ll have a rosy internal glow, because your actions will be in harmony with your highest current priority.

Maybe you decide that getting married and having kids is more important right now. In that case, you can actually be happy about the higher spending and/or lower income that typically goes with it. Why? Because you’ve thoughtfully decided this is your key focus for now.

But remember, having kids and reaching FI is not incompatible, as many readers have correctly pointed out (with one reader even compiling all his tips into this guest-post). Also, weddings aren’t all that expensive either. Big fancy parties are expensive! 😉

So do you want to be married, or do you want to have a big fancy party? If you really want the big wedding, that’s totally fine. But make that a conscious decision, rather than something you feel obligated to do.

Of course, it’s also possible to have a small wedding with only the most important people there and keep it simple.

The same goes for travel. It’s possible to chew through all your spare income on travel and ‘experiences’. But seeing the world and experiencing different things can also be done at much lower cost. If travel can’t possibly wait till you’re wealthy and a bit older, then simply have a travel cap built into your yearly spending, which still allows you to save too.

So, even though I said you can’t have it all, I’m going to contradict myself here. While you may be choosing other priorities over FI right now, you can still do those things while building the future life you want. It’ll just take a bit longer. But the point is, if you’re happier along the way, you won’t even care!

To square up my contradiction, you still have to choose a couple of top priorities and weigh them accordingly. If exotic travel, constant restaurant visits, cars, a fancy home, and designer clothes is your ultimate dream… then reaching FI at a young age is probably not for you.

Those two goals are too far in opposing directions. And while it’s still possible, reaching FI with lavish consumer tastes will be like pushing a stubborn elephant up a hill!

Suppose a couple is torn between FI and getting married/having kids. Let’s say the second option wins out, but they still really want to reach FI. They have a few options.

First, get married and have kids, while keeping the costs under control. Accept a lower savings rate due to higher spending/lower income for a while.

At this point, they’ll be happily enjoying their little family unit. And if they keep their life simple, they’ll still be able to save as well as make the most of time with bub. After a few years, bub will be nearing school-age so they can start getting serious about FI again, by ramping up work and savings.

Another option is to opt for (say) 5 years of hardcore saving, then switch to part-time work while having kids. At this point, the couple’s investments will provide some passive income and they can cruise for a while to enjoy the early years. Hello, semi-retirement 😀

Later, work and savings can be increased as desired, eventually taking this family to 100% FI. Still a fantastic outcome!

The details don’t really matter right now. The important part is deciding on your priorities and from there, developing a plan of action. Once you work this out, you’ll find life much easier and the stress and FOMO should melt away. Just like enjoying more of the simple life often leads to material desires melting away.

Oh, and forget what everyone else is doing (they’re just following each other and winging it anyway!). Focus on what YOU really want.

Regret seems innocent enough, and in some ways, it’s inevitable anyway. We all end up looking back in hindsight at what we could have done, rather than what we did do.

But if we’re making thoughtful choices about our lives and where we’re going, there’s little reason for regret. Why do I say that?

Because we’ll have made the best choices for us, based on the information and motivations we had at the time. You’ll likely find yourself later with different priorities. And that’s okay too.

The important part is, you’re creating your path. And because it’s self-selected based on your key priorities, there should be no regrets later.

Contrast that with someone who is just drifting through life, following their peers or the standard script of work, spend, repeat forever. Those are the people who will end up with regrets, because they set life to ‘automatic’ and didn’t think for themselves or decide what future to create.

The solution to FOMO is all about mindset. That’s because financial independence and building a great life is also more about mindset than anything else!

So, it’s important for each of us to do some soul searching. We need to think about what kind of life we want to have in 10 years time. Then, it’s simply about gently steering ourselves in that direction, making small adjustments as we go.

Whatever priorities you have right now, rest assured, you can still build wealth and become financially independent at a reasonably young age… unless you’re the hyper-consumer I described earlier 😉

It’s usually when we’re scattered and hazy on our direction that FOMO rears its ugly head. But getting our priorities in order forces us to get clear on what matters. And that makes sticking to your financial and life plans so much easier.

Sit down this weekend and get clear on where you’re heading and why. Either in your mind, on paper, or in conversation with your spouse. Then watch your FOMO melt away as your energy flows naturally into those key areas.

Enjoy the calming effect of your renewed focus this week. Thanks for reading!

What are your views on dealing with FOMO? Do you have any advice for those struggling with this? Share your thoughts in the comments…

This makes a lot of sense. I find myself coming a bit late into the FI journey, with circumstances that are not particularly optimal to make it happen (mid 40’s and single parent to two teenagers).

No regret though. There’s a lot of good points in this article, thank you.

Cheers Peta, glad you liked it.

This is so beautiful said. The whole point of life is to create it and experience it how we choose. Choices are everything. I once heard someone say to be successful, you need to know how to make decisions. Don’t get hung up on decisions being right or wrong, just make one and go with it. Then make it be the right one for you because it’s all about perspective and how you then choose to see the results of the decision. Even something that in hindsight may appear to have been a bad decision, know that there’s always a valuable lesson to be learned from it. Look for the gold (value) in all things. Positive mindset.

Fantastic comment Jodi, very well put!

“I want to do everything/go everywhere/meet everyone/buy everything/experience all there is.”

That is so me! I am outside Millennial age group, but that is my struggle at the moment. I want to do everything as I am a high achiever since I was a kid. But this also stresses me out as well, as it’s impossible to achieve everything with 2 young kids.

Last year, I started reading The Subtle Art of Not Giving A F*ck at my peak stress period, and it’s so so helpful. I haven’t finished the book yet, as I was distracted to achieve everything again after it calmed me down. It’s time to take the book and eat it up.

Thanks for sharing your thoughts on Mindset and the book.

Haha definitely get onto that book Eric! Then, importantly, follow its message and choose what’s worth your limited time, instead of trying to do everything.

Always come across Mark Manson references here, so thought I would post the link to his weekly newsletter in case anyone’s interested. Always a great read, but please delete Dave if not appropriate:

https://markmanson.net/newsletter

Totally, he’s like the no-bullshit self-help guru lol. Or as he’d put it, “trying to make humans suck less” 😉

He’ll be gainfully employed then… just like you! 😉

This was SUCH a good post. I have trouble with this, in typical millennial style so this was a very good reminder and a push to prioritise. Truly SMA, you are such a wise and important voice in the Australian FIRE community. Thank you for all that you do!

My pleasure AWP! And I really appreciate your kind words 🙂

This true wisdom of this post is that it’s actually a great way to live your life generally — decide what you want, then go do that. FIRE need only be part of the conversation or journey if you want it to be.

Good point mate! Thinking for yourself and making deliberate, independent choices is the true core message.

Very well said. I struggle with that too

especially when I see my peers with fancy clothes, cars, house etc. But then I always try to tell myself that everyone has different priorities and according to a few statistics 4/5 australians are in debt whereas I am not.

I guess it all comes down to how you want to live your life. I, myself, want to experience things (especially travelling the world) and spend money in that area rather than materialistic goods. It helps that I work in the travel industry and get insane discounts but then I consciously made that decision.

Ultimately when I turn 50 i rather say “that experience was a mistake” than “what if i had done that?”

It’s interesting – pretty much everything comes down to priorities, which are very individual. Thanks for sharing your thoughts Vlad.

Loved this! Such wise words. Living an intentional life is really the ultimate goal. It took me a long time, basically since discovering FIRE, to create the time and mental space in my life to be able to knuckle down which priorities matter more to me. You are right – once you know your priorities, the rest will fall into place

That’s great to hear, and interesting that finding out about FI is what helped you discover what’s important!

Working out our real priorities is time well spent. Otherwise what are we doing each day?

Not to take away from your obvious wisdom and maturity Dave but I really enjoy the abundance of common sense in your articles and most importantly the clarity of mind that i get after reading your articles.

Life is about priorities and priorities can and should change based on what life is throwing at us.

Nothing wrong with taking a year off FI for example to make that trip of a lifetime somewhere for example before we get too old. We can always get back to it but i think the problem lies with discipline and this is were most people fail.

Funny thing is and back to you point about priorities, when we decide that something is really a priority, then discipline follows, at least based on my own experience.

Thanks again for another great read.

Thanks Paul. Totally agree. When something is important and a priority, there is almost no need for discipline because the effort required to meet your priority is actually an enjoyable task 🙂

This is another fantastic post Dave which is of great help to me.

One of my children has just been diagnosed with a serious illness which will change the way we live as a family for some time. I will be trying to keep the changes relatively low cost, but this post has made me realise that I am actually choosing to save less as part of my strategy of dealing with it all. Had it not been for your post I probably would have just beaten myself up that I wasn’t spending appropriately. Instead this makes me realise that I am choosing the priority of looking after my family as best I can now at a very difficult time.

Well I came here to distract myself but got way more out of your site. Thanks

Sorry to hear about that Girt, and I’m glad the ‘distraction’ proved more valuable than you expected!

Priorities – yes. A lot of people like to be stand out in the crowd by wearing designer clothes, tailor made suits, driving the latest speed machine or simply being an early adopter of new tech. These same people brand the savers “tight arses”. I think when you are young, there is a real sense of vanity – you want to impress others – that can pervade your soul. And then the mid-life crisis hits and suddenly, people (namely, middle aged men) feel the need to parade around in public with the latest sporty convertible. Painting a picture of success is so superficial. I think you have to start questioning your actions otherwise you end up on a slippery slope that ends in anxiety and depression later in life. And besides, those types of show ponies don’t care for what clothes you wear or car you drive. They are to busy taking selfies in the mirror.