Close Menu

February 29, 2020

Welcome to my latest portfolio update!

A few times each year I give you a backstage pass and share what’s been happening with our investments.

Given the last update was back in October, it’s time for another one.

And while ours isn’t the cleanest of scenarios (far from it), I feel obliged to share with you guys how things are going. There have been some small changes, but nothing drastic.

You ready? Okay, let’s take a look.

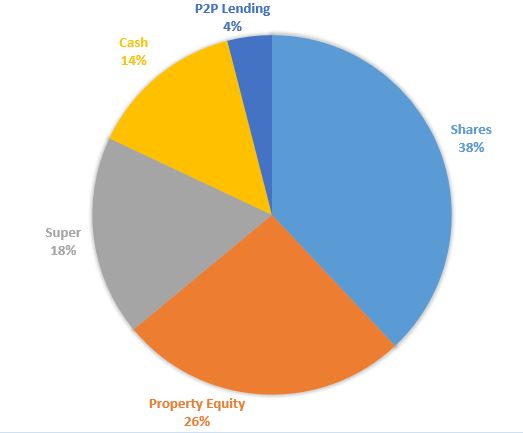

In the below chart is the latest breakdown of our portfolio at the time of writing. Figures are in percentages rather than numbers for privacy reasons.

Given I’m not really an anonymous blogger like many others, I don’t feel comfortable sharing the exact numbers. That would just feel weird.

By the way, I’ve decided to include superannuation from this point on. Even though super isn’t part of our early retirement strategy, it’s still becoming a decent pot of assets that we can access later.

With natural growth and given that we’re not living off this part of our wealth, it’s becoming a bigger piece of the pie over time. So I think including super gives a more complete picture. What do you guys think? Keep it in, or leave it out?

It’s funny – I only really update our net worth spreadsheet for these posts. Other than that, I don’t really think about it.

The recent sharemarket growth has surprised me when checking the value of our portfolio. Especially our super, which is invested in 100% international shares. Article on how I approach super here.

Each category appears smaller due to super being added, but really nothing has changed. If you’re a new reader, you might be wondering how we manage our cash in early retirement. This update explains our rather messy situation.

As I flagged in the last update, we’re now paying principal & interest on all 5 properties. While it’s nice to be paying down debt (and somewhat unusual for us!), this is hammering our cash.

The higher loan repayments are being funded from cash sitting in an offset account, as well as any income that comes in from Mrs SMA and this blog.

Overall, we’re still relatively cashflow poor at this stage and it’s far from an ideal situation. But I’d rather this than being stuck working full-time, so no complaints here!

There are no plans to sell any property soon. We’ll probably re-consider in another year or two. The cash we have will last for at least another 2 years, maybe longer.

So how’s the portfolio going? Let’s take a look.

The markets keep climbing, which on the surface seems like a good thing. But this means the income streams I’m buying are getting more expensive.

In addition, very strong recent returns mean lower future returns. Well, at some point! Sometimes that’s the dark side of great performance.

The numbers are pretty crazy. Over the calendar year, international shares returned 28%, and Aussie shares returned around 24%. This data is from Vanguard, and dividends are included.

That’s unlikely to be repeated this year. And for those who are buying, which is most of us, we should really be hoping for lower prices! Besides, it’s not healthy (or sustainable) for prices to grow faster than earnings and dividends for a long period of time.

And we’ve now had a little drop in the markets this week, so we’ll see what happens. Whichever direction it goes, the movements cause zero changes to how I approach our long term investing. Because it’s just that – long term!

People have been saying the markets are overvalued for many years now. And the doomsday people are getting all excited with the coronavirus news coverage spreading fear around the globe. The assumption is the economy and markets will now begin their inevitable downward spiral.

Are they right? Well, maybe. It’s pretty scary stuff. And I certainly don’t want to dismiss the pain of people dying.

But for those saving and investing for Financial Independence, it’s also important to put things in perspective. Remember, the world has seen much worse viruses in the past. And I mean MUCH worse – where millions of people died. Consider the following chart…

Look at the past tragedies. Note the sheer scale of them, compared to today’s crisis. Then consider the strong long term returns, despite all the scary things that have happened. Now tell me it makes sense to “wait it out” until things get better.

The world will have its ups and downs. And we never know what’s going to happen next. But unless you think we’re all screwed, continuing to invest on a regular basis is the only thing that makes sense to me.

Related post: Timing the Market: Silly or Sensible?

Property markets on the East coast have picked up since the middle of last year, which bodes well for our Brisbane property. Perth is so-so, but construction is still slow and the population is growing. So at some point, things will turn.

Rental markets have been improving across these two states as building and investment is weak. Even in Perth, the vacancy rate is now down to a very healthy 2.1%, according to SQM Research. That’s down from a frightening 5-7% a few years ago!

Anecdotally, we’re now hearing about some busy home opens. So with a bit of luck, we might see some rent increases in the next couple of years (we’ve had an increase at one property so far).

Since the last update, we’ve done a few buys and a few sells. So first, what did we buy?

Most recent purchases have been adding to our Aussie index fund. With my growing appreciation for indexing, plus that we already have most of our portfolio in LICs, I’m happy to increase this over time.

I also decided to sell our REITs and use these funds to top up our holding in QVE. Why? A few reasons.

Well, REITs have been flying for the last couple of years. The property portfolios they own have increased in value, but only a bit. Despite this, many REITs are up more than 50% in the last 12-18 months.

They’re now trading well above the value of their net assets (in many cases at a 20-30% premium). In short, they’ve become overpriced (in my view). We bought them when they were attractively priced, but now they look to have less upside potential than our other holdings.

Given our low income situation, we were able to sell these tax-free and reinvest elsewhere. Add to this, my increasing love of simplicity, and the decision wasn’t too difficult.

Also, QVE is a value-focused LIC which has struggled in the last couple of years and now trading at a large discount to NTA. So this was my very own unsophisticated form of re-balancing (selling what has outperformed and buying what has underperformed).

Sometimes that’s not easy to do. But if nothing has drastically changed with why you bought a certain investment, you should probably be buying more when it’s doing poorly.

The same goes for index funds too, of course. Okay, here’s how the portfolio looks now after these changes…

That’s right, we now have zero individual holdings! Nothing but a few LICs and an index fund. And I gotta say, I really like the simplicity of having less holdings!

Remember, our goal here is to build up a healthy level of dividend income from Aussie shares to live on. Of course, we also have backup plans, including our super and some part-time income.

As I’ve stated previously, the goal is to build our portfolio for cashflow first, and later add international shares for extra diversification and higher growth. But with super approaching 20% of our net worth, allocation to international shares is growing faster than expected.

By the way, I appreciate this may seem an unorthodox way of doing things, but we’re happy with it 😀

Here’s where the magic happens. Let’s take a look at how our income is tracking so far this financial year, using the 6 months to the end of 2019.

These figures include franking credits, but no interest earned from peer-to-peer lending. I’ll include this in the mid-year update after I get the proper tax statement from Ratesetter.

At this stage, we’re on track for a small increase on last year. This is primarily due to more cash going towards mortgages rather than investing. So, unfortunately, that blue line won’t be leaping higher like in past years! But as long as it increases, which it almost certainly will, I’ll be pleased.

Given that we now have less in high yield investments like Ratesetter and REITs, this would also mean a small reduction to the annual income figure. But that means nothing in the grand scheme of things.

Aussie companies have been a mixed bag this year when it comes to results and dividends. Companies like Westpac and NAB both reduced their dividends.

But other major companies like BHP and CSL had strong increases. Overall, ASX dividends are probably going to be flat in 2020, with the old LICs keeping their dividends stable for the half-year so far.

That’s it for another update. I’m interested to see how the year progresses after such a strong run in the markets over the last 12 months or so. And as you might expect, we’re looking forward to receiving the next round of dividends very soon!

I continue to enjoy the income and simplicity of owning shares, and secretly hope someone lights a rocket under Perth property soon so we can offload a few of these assets sooner – haha 😉

I’ll share any new happenings with you in the next update, which will be mid-year. But for now, how is your portfolio going? Share any progress, wins and milestones in the comments!

By the way, if you’re interested in the chart I use to keep tabs on our Annual Investment Income, you can get it below…

Hi Dave,

I’m happy to re-write for take 2. Though I’m not sure exactly what I wrote previously. 😉

Another great article on portfolio strategy. It gets me thinking hard to participate, seeing you have 4% on p2p lending which I assume all in RateSetter.

Currently RS has 7% interest for 5 years period. I’m just wondering whether you have considered on doing Crypto lending using stable coins, such as Compound, Celsius, Nexo, Aave, Crypto.com.

For USDT Tether token, the largest USD token, we can get 8-18% interest with locking period just 1 day. You can pull out your token anytime.

As with RateSetter, there’s always risk that the fund or company default. Few of them have insurance in place for protection. We can also purchase our own insurance.

The other risk for USDT is currency risk.

Thanks for sharing your thoughts. Cheers.

Eric

Hi Eric.

Yes I only use Ratesetter for P2P Lending. Ratesetter do have a provision fund which is managed by the risk team and has covered 100% of losses of principal & interest since starting in the UK about 10 years ago. So the track record is solid.

I haven’t ventured into any others, and wouldn’t go near anything related to crypto as I just frankly don’t like it. Too much of the marketing is slimy and promising high returns and look somewhat like a Ponzi scheme to be honest. The whole lot just turns me off, so I can’t really offer any insights into that area lol. If you’re into it, I’d just say to make it a very small part of the portfolio.

Good update mate.

I agree with the SUPER. Leave it in there mate. SUPER is going to be very important later in life and the bigger it gets the better. Also one of the best investment vehicles for producing long term wealth so I definitely have it apart of my portfolio updates.

Thanks for the feedback Ben. Makes sense to me 🙂

Hi Dave,

You mention that you “secretly hope someone lights a rocket under Perth property soon so we can offload a few of these assets sooner“. If you’re planning to replace property with index ETFs, then isn’t the optimal time to do that when property is high *relative* to the stock market rather than when property is *high*?

Thus my suggestion would be to consider reframing the question from “when can I get the most $ for my property to “when can I get the greatest number of units in my chosen ETF from the net proceeds of selling my property”. By looking at it this way a drop in the stock market can be just as effective as a rise in the property market. It may also help keep CGT low. Unfortunately it makes the decision process more complex due to the additional variables.

Like all investment decisions, you can only know the answer with hindsight, so it’s about managing with imperfect information and keeping your risk exposure within your risk tolerance levels.

Hey JD. That’s an interesting point.

It’s true on some level, sure. But I also am weighing up the amount of equity in each property and as that equity rises, there is more opportunity cost to leaving it there vs having it in shares. I’m talking in terms of return on equity here due to the leverage. Meaning for a property with little equity, there is less advantage to taking that cash out by selling and putting it into shares.

Though if the stockmarket absolutely tanks at some point, then that would definitely come into our plans, and we may look to sell off faster than expected, provided property was holding up okay. So it’s a bit of a balancing act in terms of selling when we need to, looking at the outlook for various assets over the next 5 years and checking my crystal ball 😉

Good Morning Dave,

This morning as I watch the prices continue to tumble the dividend yield on some of my LICs is becoming attractive again.

To give myself some comfort about dividend sustainability I sought out Bell Potters last report detailing Trailing Twelve Month Dividend Cover ratios. I think it is dated Sep 2019.

Given your focus on income sustainability does this ratio enter your consideration?

I am wondering if the high value of this ratio was in some way connected to the NTA premiums that have existed on some of the old LICs lately, particularly AFI who have 4 x cover. Inversely BKI (who I am big into) share price has not seen the same out sized growth and premium to NTA – perhaps due to their lower ratio of 0.9? I’m sure its not as simple as all this – what are you thoughts?

Howdy Pete!

I never look at that data, so no it doesn’t. To be honest I think AFIC is valued at a premium compared to BKI because it’s the biggest, most followed LIC and BKI hasn’t performed as well in the last few years, and has perhaps lost some popularity. Could be wrong, but that’s my thoughts on it.

Another great post Dave, thank you.

Appreciate you sharing the journey.

You rock : )

Haha thanks Gus! You rock too 😀

Love the updates as always.

I like that you are now including super. I keep a track of super overall, even though it will be accessed a long way in the future, just to see where it is at.

I can’t wait until I’m hitting $22k in dividends each year. For now, I’ll keep on hustlin’.

B

Cheers B! Sounds like everyone is a fan of including super, that’s good.

You’ll get there! Even just seeing the dividend payments increase each time (which everyone can experience) is such a great thing 🙂

Hey Dave, I quite like the Super addition to the graph, but at the same time I kind of miss the old format too. Any chance you’d do two graphs, one with and one without? Or is that getting a little cluttered for your liking?

Haha jeez mate that sounds like more work… you know I’m retired right? 😉

Will have to think about that one.

Hey mate, just wondering why you’ve started channeling a large portion of cash into your mortgages rather than continue pumping it into the share market? I’m currently sitting on a large mortgage with a cash buffer in the offset account but most of my spare cash goes into shares, especially due to such low interest rates (another .25% cut today). Interested to here your thoughts. Cheers

As the older updates explained, it’s because we’re pretty much forced onto principal & interest loans as our interest-only period has ran its course and we can’t refinance (due to being retired with low incomes and lots of debt) to get another 5 years interest-only. I would much rather pay off no debt and throw more cash into shares, but that ain’t happening for us lol hence the slower growth in our portfolio going forward that I mentioned a couple of times. Hope that makes sense.

Hey Dave

What attracts you to QVE?

Hi Daniel. I like their focus on value/income, and holding QVE gives us some extra exposure to small/mid cap stocks while keeping a focus on dividend growth. They (IML, the manager) have been running managed funds for over 20 years and have a decent track record. They stay true to their approach and don’t try to window-dress periods of poor performance (like now).

In my view, they’re a good quality honest value manager that is having a sub-par run (hence the large discount as people are giving up on them). Whether they can turn it around, that’s the risk. Obviously, I’m betting they can still do a decent long term job from here, and the large discount helps too. It’s not for everyone, but for a small part of the portfolio, I’m comfortable with it.

Great post. I reckon they’ve got some good holdings etc and like the space they’re playing in. Yield is good as well. Hopefully they’ll turn it around from a capital appreciation perspective shortly but I’m buying for 15 years time so not too phased on the month to month!

Hi Dave,

It maybe explained elsewhere but how do you survive on $21,541 Income from Dividends, plus pay P&I on your IP’s, rent a property and also invest more into LIC’s and ETF’s

Rent alone at $300 p/wk is $15,600 then there’s food etc

From memory your partner has started working again, do you do any work or get any benefits in addition to the above?

Sorry, it’s a bit nosey, but genuinely interested, as you never know it may assist myself or others

Hey Baz. Has been explained in a previous post here, which is why I mentioned it in this one and every update. That post explains how we manage our cash, and here is the rough example of what we’re doing to move our savings from property into shares.

Yes, my partner works part-time and this blog also earns a small amount of income. Your question is simply answered by realising that we sell a property every few years and use the lump of cash as needed – for our expenses, or property expenses, and investing. Have a read of the above posts and it should become clear. It’s a bit messy but that’s the way it is!

That $22k~ a year in dividends looks great!

I managed to reach around $7.5k in dividends this FY with a couple of special dividends added in. I’m expecting that to drop quite a bit as we progress through this economic downturn.

I’m quite interested to see how LIC’s are impacted and how much dividend smoothing will take place, if at all. I’ve been adding more to VAS over the last 8 months and will probably continue to do so as it’s fallen the most and I bought close to the top so it’s also a case of lowering my cost basis.

VGS has held up quite well for me possibly due to the lower AUD.

Still have work (for now) but with reduced hours, so with any luck I’ll be able to take advantage of the downturn.

Thanks for the post and portfolio update, look forward to the next one!

Cheers Scott 🙂

Nice work mate! Yes, definitely expecting to see a drop in income this year (possible a large one!) and it will be interesting to see how LICs approach it and how bad the cuts will/won’t be.

Like you, I’ve also been mostly buying VAS as the LICs didn’t fall as much during the big initial fall. Hope you stay well and manage to squeeze out another purchase or two.

Hello Dave and Everyone .

Nice to see an equal-weighted portfolio . Congratulations .

Stats over a long period shew that an eq-wtd port any other construction .

Take care .

Hi . missed a word ; outperforms ! Ramon .