Close Menu

March 30, 2018

Welcome to the third review in the series.

Today, we’ll be taking a look at Milton Corporation. This is another LIC we own personally, and are happy to hold for the foreseeable future.

For new readers, we’ve already reviewed the two biggest listed investment companies – AFIC and Argo. You can find these and the other LIC Reviews on this page.

But for the dividend investing enthusiasts waiting for the next instalment, let’s get started…

Milton was established as an investment company back in 1938. And since 1958, it’s been listed on the Aussie stock exchange, turning it into a listed investment company (LIC).

Straight away we can tell they’ve been doing something right, to be around that long and still be prospering.

Nowadays, Milton is the third largest LIC in Australia, behind of course, AFIC and Argo.

Today, they have a diversified investment portfolio worth $3 billion. They currently hold shares in close to 100 different companies and trusts. And their primary focus is delivering an increasing dividend stream to shareholders.

They take a very long term view, and the investment committee has significant experience. Also, the company is run in a low-cost, tax-efficient manner with low turnover in the portfolio.

Here is Milton’s goals, from the company website:

1) Increase fully franked dividends paid to shareholders over time

2) Provide capital growth in the value of the shareholders’ investments

3) Invest in a diversified portfolio of assets which are predominantly Australian listed companies and trusts

Obviously, with these goals in mind, Milton has a strong focus on companies that pay dividends. And companies which they expect to deliver sound growth in dividends over time.

Clearly, this ties in very well with our own goals. Owning a vast pool of companies which spit out increasing chunks of cash, is the ultimate retirement income stream.

Milton holds a large diversified portfolio – close to 100 companies and trusts. And like the other big LICs, they have the bulk of their funds invested in the largest companies on the ASX.

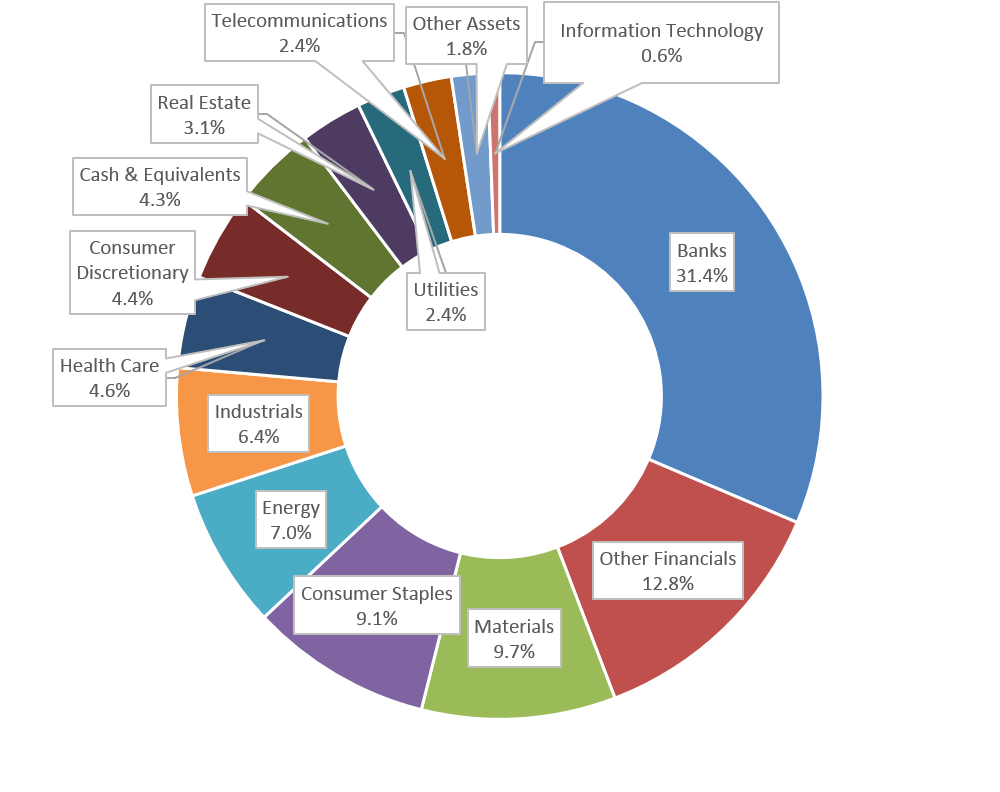

Let’s take a look at the breakdown by sector…

So, we can see that Milton owns a lot of banks and other financial stocks. In fact, more than the other LICs. Because of the strong run banks have had over the last 20-odd years, they have come to dominate Milton’s portfolio, and indeed, the Aussie sharemarket index as a whole.

In some respects, I admire Milton for sticking to what they believe will be a solid dividend-producing portfolio into the future. But on the other hand, I think it’s best not to be too reliant on one sector for income.

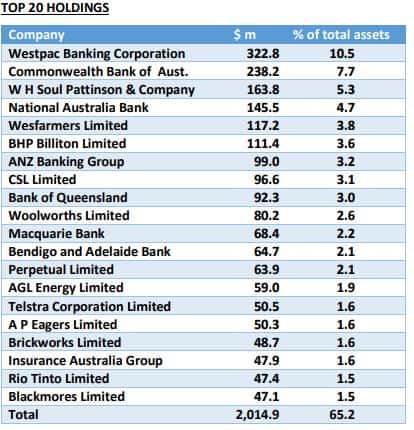

Now, let’s look at Milton’s top 20 holdings…

So to me, this is interesting. Milton’s top 20 holdings vary more from the index than one might expect. They have large holdings in stocks that aren’t even in the ASX top 20. Stocks like Washington H. Soul Pattinson, AP Eagers, Blackmores and Brickworks.

They also have only small holdings in companies where they’re less convinced of the long-term income potential. Despite those companies making up a much larger portion of the overall index.

I view this as a positive. Seems to me, Milton is even more of a stock-picker than other LICs and has conviction in what it’s doing.

It doesn’t matter if these companies aren’t familiar. What’s important is, Milton sees potential in these companies to provide a good flow of dividends now, and into the future.

So while they’re a bit heavy on banks, the portfolio is still diversified. And overall, Milton has a nice spread of dividend-paying stocks.

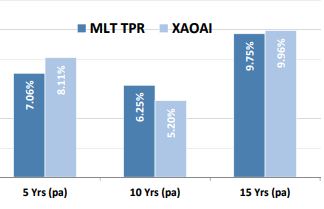

Now let’s take a look at how Milton has performed over the long term.

As we can see, over the most meaningful time frame (15 years), Milton has performed roughly in line with the All Ordinaries Accumulation Index. But we should note, Milton’s returns are after tax, and after management fees, whereas the index figures are not.

If we included franking credits for both, and fees for the index, Milton would be ahead. But in any case, we’re splitting hairs. Total returns have been similar. Both over 11% p.a, after franking, over 15 years.

Each investor will receive a different after-tax return of course, depending on their own tax-rate. That’s just the way investing works.

But remember, we aren’t investing in Milton to beat the market. We’re investing for a solid dividend stream which grows over time. So let’s see how they’ve done in that area…

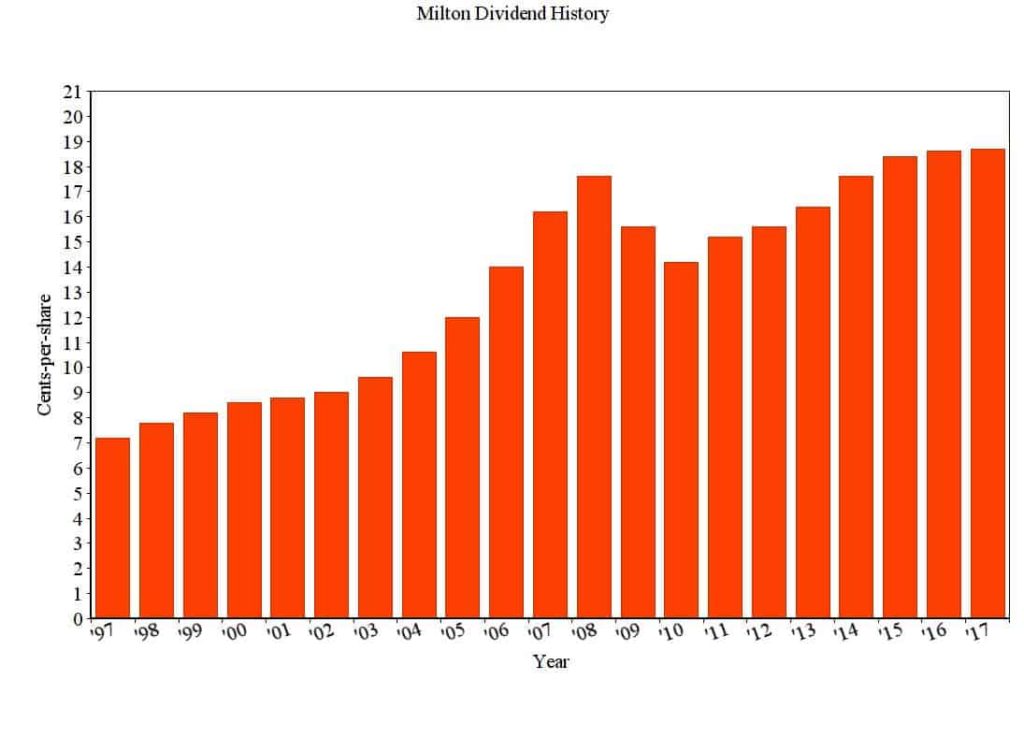

As regular readers will know by now, this is the most important metric, in my view.

Here’s a chart of the dividends Milton has paid to shareholders over the last 20 years…

As we can see, just like with Argo, Milton had a huge increase in dividends as the economy was booming, before the GFC. Incredibly, dividends increased by over 80% in the 5 years leading up to the GFC. Then, they were reduced to more normal levels, where dividends have continued to increase, in line with their long term trend.

Anyway, these figures show Milton has grown dividends at a rate of 4.9% per annum, for the last 20 years. And over that time, inflation was 2.5% per annum.

While I’d prefer the dividends were smoother than that, they’ve done a good job, in my book.

Remember, an ever-growing dividend stream is the name of the game. As far as I’m concerned, for investing, it’s about as close to heaven on earth as it gets!

As an interesting side note, I managed to find some longer term history for Milton. According to their 2014 Annual Report, an investment of $2000 back in 1958 would’ve yielded an annual dividend of $160 the following year in 1959.

Now, if we fast forward to 2017, that initial parcel of shares would now produce an annual dividend of $5,335. This is assuming the dividends are spent every year and no money is ever reinvested.

What does that tell us?

Well, Milton has been able to grow their dividend at a rate of 6.2% p.a. And our old trusty RBA Inflation Calculator, tells us inflation was 4.8% p.a. over that time.

So this means, Milton has been able to increase its dividend faster than inflation for 60 years. That’s incredible!

But in truth, there’s nothing all that strange about it. Company earnings in Australia have grown faster than inflation over the long term. And this naturally allows them to pay larger dividends over time too. Indeed, it tends to be the case for most developed economies.

While long term data is usually hard to find, I’m glad I did some digging and found this example.

Now it should be pretty clear why I love dividends so much. Over the long term, your income is almost certainly going to increase ahead of inflation.

Milton has very low fees.

The costs of managing the portfolio are currently 0.12%. Honestly, that’s about as low as it gets.

Since Milton has internal management, there’s no fees paid to outside managers. And there’s also no performance fees. Basically, the costs to run Milton are mainly for staff, office costs, and share registry fees.

As the portfolio gets bigger, the costs will stay roughly the same. So the management expense ratio (MER) is likely to get even lower over time. Same as our other LICs we’ve discussed so far, this aligns well with shareholders.

I like Milton’s very long history dating back over 60 years. Also, the fact that they aren’t afraid to have their largest holdings be different from the index. Essentially, that’s what we want.

We want them to have conviction in the companies they’re buying. And manage the portfolio based on its long term income potential, regardless of what the market is doing.

Milton runs a tight ship, as far as costs go. Their expense ratio is roughly in line with AFIC, who is twice the size they are.

Recently, Milton has added a new member to their investment team who has experience in finding opportunities from the disruption that new technology creates. Hopefully this helps them uncover future lucrative investments, or identify risks in their current holdings.

Most of all, I like their strong focus on finding good dividend-paying companies, to add to the already dividend-rich portfolio. Just like with the other LICs, our own goal perfectly aligns with Milton’s – that is, investing for a solid income stream which grows over time.

Although I’ve said it’s a plus overall, Milton’s stock-picking has resulted in the portfolio being heavily invested in banks and the financial sector.

While this might turn out to be a good move over the next few decades, in my view, it’s adding risk by being more reliant on one sector.

And Milton’s dividend growth track record, while impressive, is not as smooth as the other LICs we’ve covered.

Also, I could complain that they haven’t beaten the market in recent years. But for an investor focusing on income, that doesn’t matter so much. What counts, is the increasing amounts of cash being received, not share price growth.

Anyway, I’m really just nit-picking now. They’ve done a good job for the last 60 years, staying true to their dividend growth focus.

To sum it up, Milton is a very low-cost way to own a large portfolio of Aussie dividend-paying companies.

The company has a solid long-term track record. They aren’t afraid to be different and own large stakes in companies that aren’t big holdings for other LICs, or the index itself.

Shareholders in Milton, for many decades, have been well rewarded with a regularly increasing income stream. And I expect this to continue far into the future.

For that reason, this LIC is one of our largest holdings. And I’ll definitely be adding to my position over time.

Currently, Milton is on a dividend yield of 4.1%. Or, 5.9% when grossed-up to include franking credits.

Clearly, I’m a big fan of Milton and it’s investment philosophy. As early retirees, it’s comforting to know you’ve got a bunch of professionals with decades of experience, managing a big portfolio of shares, to deliver the best income stream they can.

All this at a very low cost, with nothing to do but sit back and watch the cash come in!

If you enjoyed this review you can find my other LIC reviews here, including BKI, Argo and more.

Recommendation: The low cost broker I use to buy shares is Pearler which is purpose built for long term investing. Simple, clean and great features like Autoinvest, with none of the trading-focused rubbish other brokers have!

Join using this link and get free brokerage on your first investment. Pearler also have a referral program, meaning if you sign up using that link it supports this blog, so thanks!

Hi Dave,

Enjoyed your review on MLT. I recently bought some at 4.55, only to watch it drop immediately. I would be interested to know your thoughts on entry price for buying LICs.

Traditionally, the approach was to buy at below NTA. I just wonder whether it is a better approach to buy only when the dividend yield is above the long term yield of 4.1% (e..g for MLT as you have mentioned in your post). For example the current yield is 18.8c per annum on MLT. So on the basis that MLT generally has not cut its dividend for many decades, the entry price for a 4.1% yield would be no higher than 4.58 regardless of NTA. What do you think about this?

Thanks Jon.

Regarding entry price, there’s no magic to it. If you’re happy with the yield on offer and expect it to grow over time, then the market price is likely fine. Keep in mind the NTA though as you’ve mentioned. Just have a quick check and make sure you aren’t paying way more than the portfolio is worth. With the traditional LICs like Milton, the price is usually pretty close to NTA so it’ll often even out over time.

I don’t buy based on yield alone, because if the market starts increasing from here, you may not be buying for many years, if we go through a bull market. This isn’t a great idea when trying to accumulate shares, especially for early retirement, and it is similar to market timing. I think dollar-cost-averaging is the most sensible option – just buying regularly over time. Hope this helps.

Great review! As you know I’m a MLT fan! It is currently my seconded largest holding. LICs make investing easy…they do all the hard work for us (stock selection). While indexing is great, LICs cut out the low dividend paying stocks and have a almost 6% grossed up yield. Wahoo! I’m looking forward to the next review.

Cheers mate!

Completely agree – while we may miss out on some big winners from the index, we can also be certain our portfolio will still have a good spread of stocks and have a dividend focus. Although it’s still likely to produce reasonable dividends, income is not a focus for the index. So the LICs feed our greedy dividend-hungry bias!

I love and own Milton too. Have been buying up recently as it is running cheap(ish). I really enjoy these LIC write ups very much indeed. Can’t wait for the next one.

Thanks, appreciate that Phil.

Most of the classic LICs look good at the moment I think. Prices have come back a bit, while earnings/dividends are actually improving.

Living solely on investments, its vital that our investments can produce a steady stream of rising dividends over the long term.

After looking at various Lics, I’m actually leaning towards the Grandfather Lics such as MLT, ARG and AFI….sure, they will more or less track the index and won’t outperform the market by a wide margin but they also won’t underperform by a large margin.

I can accept volatility in the market, in fact, if the market crash tomorrow and fall by 50% and my MLT, or ARG fall by 50%, I won’t be worried……but if I was to invest in some other Lics such as BAF and without knowing or fully understand their investment process…then I will be worried seeing them drop by 10% like what happened last week when a negative report came out regarding the integrity of BAF management…..

I feel confident by investing in MLT, ARG and the likes. I understand their investment process, transparent holding, long track record and transparent fee structure, they won’t make you rich over night but will make compound work for you…… holding them will be very similar to holding ETFs or indexing but I still prefer Lic

Good comment, thanks Jack.

You’re right of course, these LICs won’t shoot the lights out. But they won’t be disasters either. I think of them as similar to the index, but with an income focus.

Well, bad news coverage/report will hurt almost any company or fund, just like bad news affects the market as a whole. In that case in particular, it will be interesting to see how it plays out. If the allegations are true, it’s basically fraud and theft from investors over the last 10+ years.

I agree completely that leaning heavily towards the lowest risk LICs like you’ve mentioned is the simplest, easiest and safest choice, out of the now large LIC universe. Just like the index, they virtually guarantee a satisfactory result over the very long term.

Thank you for demonstrating that dividends have been able to grow faster than inflation for the past 60 years! Gives me alot of confidence this is likely to continue in the future.

A growing income stream in retirement that requires zero effort from the investor is definitely like heaven on earth!

No worries, glad I could find the data!

Couldn’t agree more mate, it doesn’t get better than that 🙂

Dont own Milton but they do a similar job to AFIC, ARG and the like, I own several of their top ten as seperate stocks so maybe thats why I have avoided them but I see them as a reliable LIC who I might look at down the track if and when their portfolio changes to being less bank biased. 4.1% with franking credits is ok with me but if Bill Shorten gets his way then LIC’s like Milton might be less attractive to a self funded retiree like myself who has no centrelink benefits. It will be interesting to see how all the LIC’s handle that situation and how much FUM they lose to other higher paying stocks like REITS etc..

Cant go wrong with Milton in the short term though and your divvies will keep rolling in like clockwork and hopefully keep growing so you cant ask for much more than that and really it gets down to personal choice about the stocks you prefer in your LIC whether you take Milton over the other LIC’s.

John Abernathy from Clime has an ad on the right hand side of this page and its about being careful about holding too many bank stocks so since I own Clime Capital shares maybe I should listen to him and not look at Milton till they diversify a bit more!!!

You’re right Mark, the large LICs are all very similar. Franking changes will make them slightly less attractive for lower tax bracket holders since the LICs pay tax on unfranked dividends. Since they become slightly less efficient under the proposal, compared to an ETF for example, they may look to hold less REITs, infrastructure stocks and the like, if it’s going to hurt the end shareholder’s after-tax return. But LICs cannot lose FUM (Funds Under Management), because they’re a company vehicle. So for all the folks who sell their shares to move money elsewhere, someone else is buying shares. This is how they differ from a managed fund, which shrinks or grows as people put money in or take it out. The drop in demand for LICs may see them trade at a discount.

I’d say anything can happen in the short term, but holders will do just fine with Milton over the long term. Tax rates etc have changed many times before, and Milton has been a solid profitable LIC since before franking credits were even around – let alone when they became refundable in 2000.

I believe Milton will continue to be a solid investment over the next 50 years as well. If you also own an LIC which focuses on small/mid size companies, then you end up with a very nice spread of companies along side Milton’s holdings, which tend to be larger size companies.

Hey Dave, I’ve had my eye on Militon for a while, but I’ve only every invested in AFIC. What’s your take on the AFIC vs Militon debate? Should I switch to Militon?

Hey Money Professor – cool picture by the way 🙂

I’m not sure there’s much to debate really. I wouldn’t be switching, there’s nothing to be gained by that in my view. They’re quite similar beasts and will likely perform roughly the same as one another over time as well. Simply a matter of which one you prefer, or you could just buy both, as I have.

Hi Dave,

Just a quick comment to say I appreciate the blog! Plenty of interesting topics discussed and you provide a really educated and balanced method of writing.

Thanks again!

Thanks for reading Anthony, and your comment is very much appreciated!

Dave great site mate, about your comment small/medium size LIC’s I think you mentioned previously you hold WAX , as i do , any others you think are worthwhile. I personally am interested in PIC they hold a diversified number of “not top 10 ASX” along with some O/S stock. They are only a young LIC but have increased dividends every year since inception. Vince Pelluzo, i think, seems pretty switched on as manager and as they trade pretty close to NAV look like something to keep an eye on. Any thoughts?

Thanks mate.

I also think QV Equities (QVE) is definitely worth a look (which we own), and also Mirrabooka Investments (MIR). Both run by long term managers with strong performance over the long term. MIR is managed by the same folks as AFIC. And QVE is managed by Investors Mutual, who run some very successful unlisted managed funds with solid long term performance after fees over 20 years, especially in the small cap area.

I have only briefly looked at Perpetual. It looked interesting, but I’d rather have LICs which focus on a certain area, rather than everywhere. If I want overseas shares exposure, I’d rather do it in a complete way by going for an international index fund or even perhaps using a global LIC like Platinum (PMC). For me, it’s simpler to mentally map out where my money is invested. Perhaps I’ll take another look at some stage. It definitely looks fine though.

Hi Dave, I’m totally new to investing (just mentally and physically preparing for my first trade!) so sorry for the basic question but –

is it better to invest in one type of LIC (such as AFIC, ARG etc) or is it better to spread my investment across a number of these (similar) LICs (noting they’re fairly similar in outlook etc)? I note you own several that are, to a novice like me, very similar. Is there an advantage to spreading your invest pot?

Hi Natascha, don’t be sorry at all, it’s a good question.

You’re right, they are very similar in strategy and portfolio.

There’s no rule that says you must own all of them, but most LIC investors decide it makes sense to buy more than one, it does help to reduce manager risk (if for some reason the LIC starts changing its strategy or choosing terrible companies etc). With these old LICs where they’ve been running for 50+ years that risk is very low. Its up to you of course, but to me, having one LIC for a starting portfolio is perfectly fine as it helps to keep things simple.

Well done on getting started, and happy investing 🙂

Hi Dave love all your work and always look forward to reading your new articles. Have you got an opinion on vanguards vhy? They interest me because they pay dividends quarterly

Thanks Luke 🙂

I used to hold VHY actually, but these days not really a fan. While it’s had pretty good returns overall and a high dividend component, there’s some traits I don’t like…

It holds only 35-40 stocks at a time (many in the same sectors) so not very diversified. I didn’t like that the distributions were different all the time, sometimes by a large amount. And I didn’t like how the strategy worked in practice – it held a lot BHP a few years ago because of it’s huge ‘forecast yield’ but it became obvious that BHP were going to cut their dividend due to a large drop in profit, which they did, massively so. And after this, the position was exited from what I remember, as it was no longer high forecast yield.

So while it’s probably fine for a long term holding and it should do ok with large dividends, I’ve decided it’s not for me and I prefer the old LICs who hold a blend of high yield low growth stocks and low yield high growth stocks, often totalling around 100 companies. This seems like a safer option to me and they more closely resemble the index, albeit with a bias towards income. Hope that helps!

Yeah that makes sense . Thanks very much for your reply. Looking forward to more lic reviews????

Cheers Luke, me too!

Mate, absolutely love the site! Really enjoy all the articles, especially the LIC reviews. You have already taught me a lot, so much appreciated! Was just wondering if you had any idea about how large the dividend reserves are for the three LICs that you have reviewed. I saw on the most recent monthly LIC report put out by Cuffelinks that there was a list of the top 10 high yielding LICs and how many years dividend cover each had (for example, WAX has 3.8 years worth at their current yield but WAM only has 1.4). Do you happen to have this kind of information for the LICs you hold, or do you know where I could find it?

Thanks for reading Dave, appreciate the kind words (you’re like the 3rd or 4th Dave around here lately, what’s going on!)

For dividend reserves, I don’t have those figures, sorry. But I’ll say for the old LICs which mostly just serve to pass dividends on to shareholders, there is very little need for dividend reserves – they’re basically just passing the cash straight on to us. Whereas in the case of the WAM funds and other active managers that pay very high yields, most of those dividends are actually paid from capital gains. So the fund needs to keep harvesting capital gains for the dividends to be sustained. Clearly in this case there is more need to have some ‘dividend reserves’ in case they’re unable to harvest capital gains for a couple of years due to market conditions etc.

Given the older style LICs pay out slightly less than their total income most of the time, their dividends are much more reliable and not reliant on capital gain harvesting. Because of this, I’m not too worried about their dividend reserves. They generally will have enough cash and excess franking credits to sustain their dividend for us, even if the portfolio generated less in dividends for the year – as AFI has done recently. Bit of a long-winded answer sorry 🙂

Haha, so true, Daves are breeding like rabbits around here!

Thanks for your answer mate, it makes a lot of sense. I ended up going back over some of the stuff I read a bit more closely and saw that the five largest LICs have dividend reserves of around 2 years. Like you said, perhaps not crucial but good to know.

Good job checking up mate. If there ever comes a time when those LICs receive absolutely no income for 2 years from their investments, then I think we have a lot more to worry about – corporate profits will have possibly disappeared! Better buy some baked beans and bitcoin as a backup 🙂

HiDave, like this article and am looking forward to reading more in the near future. Very good advice.Thank you .

Thanks Brian, glad you enjoyed it!

Hi Dave,I have only recently discovered your site and enjoy it thoroughly. As I’ve only recently started investing in individual stocks,Im very interested in investing in LIC’s.

I have read your reviews on AFIC-MER 0.14%, ARGO MER 0.16% MILTON 0.12%. Although all 3 LIC’s seem similar,wouldn’t it be better to choose the lowest MER,as in Milton,compared to AFIC & ARGO?

In choosing the lowest MER,wouldn’t this have a big difference in your overall return given that your investing for the next 15 years plus?Thanks Dave,really enjoy your reviews and comments

Thanks Trevor and welcome!

As for the fees. 0.02% difference – I wouldn’t say that’ll make a big difference. (Aussie Firebug would yell at me for that 🙂 ) The main reason that people hold a few LICs is for risk management and performance smoothing. Although they can be expected to perform at a similar rate, they will each have times of slight under/outperformance. And their dividends will each be increasing/flat at slightly different times. Example, Milton and Argo reduced their dividends during the GFC. but AFIC did not. Last 2-3 years Argo’s dividends have been increasing, AFIC’s have been flat.

Holding multiple smooths this out. And mainly it protects against one of them doing poorly over the long term compared to the others for some unknown reason.

Also, there’s more chances to buy the companies when they trade at a discount to NTA (the value of their portfolio). And every now and then they raise money from shareholders at a discount and no brokerage cost, to expand their portfolio. Holding more than one LIC gives more opportunities like this over time.

Some of this stuff is not worth the hassle for some people, so they end up going with the index – VAS… a larger portfolio of shares with a mostly increasing income stream, just with payments a bit lumpier. Other people choose both. Buy LICs when they’re at a discount or trading around NTA, or buy the index when LICs are trading at a premium. Not a massive difference either way.

Hope that helps more than confuses 😉

Hi Dave,thanks for your comprehensive explanation,as Ive explained,Im on an early learning curve with investing.I would also like to invest to produce ongoing income.I enjoyed your reviews on the major LIC’s.I was curious you mentioned VAS.Have you reviewed VAS at all and compared it too AFIC ,MLT & ARGO?

The entry price of VAS-$77.63 appears to be very expensive compared to the major LIC’s

Is it worth paying the higher price for VAS and do you think the higher payments/returns are worth it compared to owning 3 LIC’s?.Would appreciate your thoughts. Thanks Dave

No problem Trevor. The three major LICs are quite similar to VAS (the index) in the stocks they hold and the yield they generate.

The share price of VAS doesn’t mean much, you’ll still receive around a 4% yield plus franking credits – similar to the LICs.

Think about it, just because Milton is $4.50 and Argo is nearly $8, doesn’t mean Milton is far far cheaper. Likewise it doesn’t mean Argo is 10 times better value than VAS. It doesn’t work like that. You’ll currently receive around a 4% yield plus franking with both options. Perhaps look at them individually rather than in (price) comparison to each other 🙂

Hi Dave , some great points and discussions here. Are you a fan of BKI ? Their grossed up yield Is just under $7 at the moment. Seems pretty good to me and can’t seem to find any negatives?

Thanks Luke.

Yes I do like (and own) BKI, it’s a good LIC overall – I’ll do a review on it soon. A negative perhaps is they have a higher allocation to banks/financials than some other LICs and less diversification overall. The portfolio is just under 50 stocks, whereas Milton for example is around 100.

Yeah ok some food for thought. Iv got a small holding but think il top up again. Cheers for the quick reply????

Hi Dave,

Given that the fees for most of the LIC’s are relatively low, and as you pointed out, not a huge difference when comparing MER’s. Wouldn’t the fee’s impact your long term objective of investing and your returns for the 10-15 years that you would be invested. Would the lowest MER be more favorable over a long term of investment. Surely paying a higher MER fee over 10-15 years would be significant, compared to paying a lower MER over the same time frame? Do you take these fee’s into consideration on the returns you are receiving?Cheers & thanks Dave

Trevor, I sorta answered this before.

You are free to choose 1 LIC if you prefer the lowest absolute fee, but I personally prefer to own multiple for the reasons explained earlier. The extra benefits/diversification may or may not be worth 0.02% per annum to you.

The dividends paid to shareholders are after the company’s costs, so in many cases, as long as the end shareholder is receiving a decent and growing income stream, the MER being 1 or 2 basis points higher is not the end of the world.

Also who’s to say they’ll have exactly the same performance? They’ll be similar but I bet the difference will be bigger than 1-2 basis points. So by owning multiple you get an averaging or smoothing effect of performance and dividends, while reducing manager risk, as I mentioned earlier.

The problem with this thinking is today AFIC might have the lowest MER. But what if in a few years, Milton grows and manages to reduce costs and they end up with a lower MER, certainly possible. Would you sell, pay tax and switch investments? I sure as hell wouldn’t. It’s such a small amount it’s obscene to worry about. In any case, they’re all extremely low cost, long-term and dividend-focused vehicles.

Hi Dave,

I am confused – when I participated in the Milton Share Purchase Plan in 2007, each share was worth $22.50. Today, I see they are worth $4.77. My questions are:

1. Why is the cost, per share, higher in a Share Purchase Plan?

2. If I purchased more shares today, through a broker, would each share be $4.77?

Thank you in anticipation, Leah

Hi Leah,

In 2013, Milton split its shares 5 for 1, so each $22.50 share you owned was replaced with 5 shares worth $4.50 each – the total value of your holding would have stayed the same. And yes if you purchased today, the shares are now $4.77 each.

Hope that clears up the confusion 🙂

Yes, that makes sense now, thanks! Kind regards, Leah

So a bit that’s relevant when I look a bit deeper is the degree of incest via the Millner family and the concentration risk. This could be a good, or a bad, thing obviously. If they’re Buffett then boom. This link explains the proportional holding of Soul Patts and Brickworks – something which occurs in the context of cross-holdings between those two companies and the third arm to the equation which is BKI. It’s on the cusp of getting a little too complex and cosy for mine and seems all about ‘control’. Again, not sure if this is a good or bad thing for governance and corporate protection vs decision making.

Starting to see a disturbingly similar picture occurring with Argo and the executive cross pollination with AGLI and the flow of fees. Makes you want to keep wandering into ETFs.

Go WHF!

Yep there is a fair bit of cross-holding going on, which I have mentioned a bit more in my reviews of BKI and also Soul Pattinson. Historically, the family has been a great wealth creator through their vehicles over many decades, so I think they get a pass where others wouldn’t. But like you say, it’s only a good thing as long as interest/governance/ethics hold up for the retail shareholder.

One great thing about ETFs is there’s little need to think about such things!

It does not look like there has been much activity on this site for years. Is it still operating?

Milton was taken over by another company a couple of years ago and is no longer operating as an LIC. It was purchased by Washington H Soul Pattinson, a company which I wrote about here: https://strongmoneyaustralia.com/lic-review-whsp-soul-pattinson-asx-sol/#:~:text=Along%20with%20strong%20total%20returns,that's%20a%20conservative%20payout%20ratio.