Close Menu

April 25, 2020

Large swaths of people are getting an unwanted taste at retirement right now.

Many are working from home, sure. But lots of folks aren’t working at all, even though they’d like to.

These circumstances are far from ideal, and it’s causing a great deal of stress and anxiety. But it’s also unique and offers some great lessons.

So even at a time when lives and jobs are being lost, there’s usually some positives to be found within a broadly negative event.

And that’s where we turn our energy today. Let’s run through some possible upsides to the current situation and see how we can make the best of it.

Clearly, many of us now have more idle time than we’re typically used to. Even for those still working, reduced hours and working from home is common.

Extra spare time can be really good for mental clarity. We can contemplate our lives and where we’re headed, and make adjustments as desired.

Free time and mental space is also great for creativity and generating ideas. In fact, most of my article ideas come when my mind is clear and I’m not doing anything.

Maybe you’ll come up with a cool business idea that’s worth investigating. Or a way to use this extra time to help someone you know.

This break from the norm is also a great opportunity to build healthy new habits. I’m sure we’ve all got at least one thing we want to make part of our routine, but for whatever reason, it just never happens.

Maybe it’s meditating, a morning/evening walk, spending more time with your kids/pets, or just reading a few pages of a good book each day. Now is the perfect time to build a new habit.

Just start small, with a few minutes per day. Build momentum by keeping the streak going and work up from there.

More than anything, current events are a reminder that health is more important than everything else. Without it, we have nothing.

For the most part, great health is built upon habits. So let’s make sure our health is getting top priority right now.

This means non-negotiable daily exercise, nutritious home-cooked meals, and quality sleep is a good start. Not to mention the other factors listed here that assist with mental well-being.

From what I can tell, people are definitely using this time to exercise – the parkside bike path across the road from our house has never been so busy!

It’s also a fantastic time to devote some energy to self-education. Learning is one of the most fun things you can possibly do with your spare time.

This can simply mean researching topics you’ve always wanted to learn about ‘someday’, whether through books, Youtube etc.

Or it can be something more involved like an online course. Whatever you want to learn more about, now is the time to get stuck in!

When you’re learning, your brain kicks into overdrive and you get a rush from the fascination of it all. Well, that’s how I feel anyway! Is that normal? Let’s assume it is 😉

If you haven’t felt this, then maybe you just haven’t found subjects that you’re passionate about yet.

If you haven’t heard, the big winner from the economic shutdown is Planet Earth!

Less driving, travelling and people and goods being transported is seeing emissions fall and massively improving the air quality of our cities.

In my area, on our regular biking trips to get groceries, we’ve noticed a massive drop-off in cars driving around. It’s definitely strange, but it’s nice to not be breathing in the shitty fumes spewing out from regular traffic.

Not only that, but we’re generally buying less stuff overall, which has further positive impacts on our global footprint as humans.

Whether they like or not, many folks are currently experiencing an involuntary trial of early retirement.

And while it sucks for people who are struggling financially, or who are sick, I think it’s a positive for others. Especially those already on the path to Financial Independence.

Having this huge gap where work used to be, will allow people to see how they cope with such massive free time. Some will absolutely love it, and others will struggle.

If you’re the kind of person who gets bored quickly, or who is highly social, you’ll need to adapt fast and find new stimulating things to do. But if you’re good with quiet time and doing your own thing, you’re probably just enjoying the freedom!

After an anxious few weeks of lockdown, I think people are starting to get used to this new normal. Once we accept these conditions are with us for a while, it allows us to relax a bit.

This is giving people permission to start living life at a slower pace. The always-on, hyper-competitive, rat race culture is taking a break. And that’s a win for happiness and mental health. Instead, we can focus more on health, family time and self-directed learning.

Related to the above, people are spending much more time bunkering down at home. This is a great chance to start appreciating the simple life. Embrace it, because it’s happening anyway!

Our lives are now forced to be less consumer-focused. No more mindless shopping. Fancy restaurants and bars are closed. And travel bans are in place.

Instead of this, we’re (hopefully) reading more, exercising, creating things and making our home-life as enjoyable as we can.

All this will result in an effortless decrease in household spending for almost everyone. And my sincere hope is, as this continues, people will realise “hey, this isn’t so bad!”

Then, when things get back to normal, they’ll look back on these times fondly. With any luck, they’ll notice that maybe the high spending treadmill isn’t making them happier after all.

Even if things return to exactly the way they were before, it’s possible people will be more grateful. It’s hard to live through something like this and not have it affect you in some way.

We may become more grateful for our health. For unlimited outdoor time and unrestricted events. For being able to go out to eat at our favourite places.

Even simple things like meeting friends for coffee, or having a family gathering. Will we appreciate these things more when we get to do them again?

There are tons more people who’ve now started working from home, or are being encouraged to. Capabilities for this are increasing with many workplaces now aiming to make this an increasingly available option.

While it’s not for everyone, there are some upsides to this. It offers greater flexibility for staff, who can avoid their morning commute, saving tons of time and driving costs.

The employer will also benefit as less staff in office means less floor space needed. This allows companies to save on rent, which is one of their largest expenses.

As mentioned earlier, the free time created from the shutdown lends itself naturally to new ideas and creative energy.

But for all of us, by learning how to adapt to the current situation, we’re forced to come up with new ways to entertain ourselves, maintain relationships, be healthy and productive.

Some are using this period to help others with free home-delivered food, alcohol companies are making hand sanitizer, singers are doing free shows from their homes, while others are simply making funny videos to entertain the bored masses.

Here’s one which I enjoyed lol…

Plus, there’s bound to be numerous businesses being born and partnerships forming right now. These and other companies will grow and come out stronger on the other side of this, while others sadly won’t make it.

Now is a great reminder of why personal finance is more important than your investment returns.

So it’s time to get our money in order, and find new savings in our current spending. This will happen automatically in many cases, as we can’t spend money on things like travel and restaurants even if we want to!

But we can see this experience as a great way to reconsider our needs vs wants.

Markets have picked up in the last month or so, after a brutal decline of around 35% during Feb-March.

How did you feel during that selloff? If you were feeling constantly anxious or worried about your portfolio, this is an opportunity to rethink your investment approach.

Do you need to be less invested and hold more cash or bonds? Do you need to diversify more? Or maybe you’re finding that shares stress you out so much that you’ll feel better with your savings in property?

I’m not here to argue one way or the other. As I’ve said many times, you need to invest in a way that you are comfortable with.

Don’t worry too much how everyone else invests. Do what feels right for you and your situation. Otherwise you might end up throwing in the towel at the worst possible time. Not only that, but the extra stress will eat away at you.

If cashflow is tight right now, there’s always the option of deferring your mortgage payments for 6 months. Yes, interest still accrues, but if you need the breathing space, it’s great to have the option.

Interestingly enough, we’ve chosen to do this at the moment, to free up more cash for investing. It might sound insane, but if you expect to earn a higher return than your interest rate, then it can make sense.

As alluded to in a recent article, we’re now paying 2.4%-2.8% on some loans. Since I expect shares to have a long term return higher than this, we’re happy to put these on pause and buy some extra shares instead.

You can still make repayments if you want, so it’s a very flexible option to consider. Which leads into the the next positive I’m clutching at…

It’s hard to argue markets are cheap. Earnings are going to be absolutely hammered over the next year or two. The outlook now seems worse than it did when I wrote my earlier article on the market crash.

But this isn’t forever. Profits and dividends will eventually recover. How long it’ll take, I have no idea.

It’s important to remember, we’re getting a lower price on the permanent value of these companies. Yes, some will be permanently damaged, while others won’t survive. But I don’t believe the market as a whole is damaged forever.

A couple of years earnings may be wiped out, but I don’t think the next 30-50 years has changed all that much since January.

If you’re going to be buying anyway, you might as well enjoy the lower prices. The recent volatility might have caused some long lasting mental scars for investors though!

ScoMo & Co are spending increasing amounts of cash to keep people and businesses afloat. It’s been the biggest fiscal rescue package in our history.

Many armchair experts are complaining that the government is spending too much, others say it’s too little. There are cries about government debt and future generations.

This article (although US centric) is a good guide to why government debt isn’t as big an issue as some suggest. And keep in mind, the Australian government has much lower debt relative to our economy than other developed counties, making it something of a non-issue.

Anyway, I’m actually impressed at how this has been handled.

I wouldn’t have thought our Liberal government would do things like double the unemployment benefit, hand out multiple cheques to those who need it most and put the economy into freeze-mode for the sake of national health.

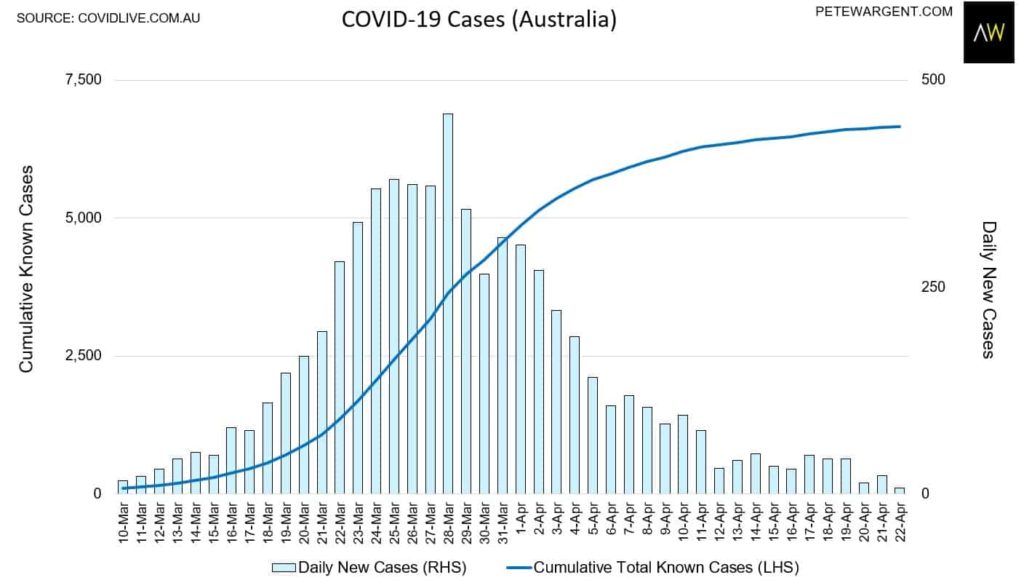

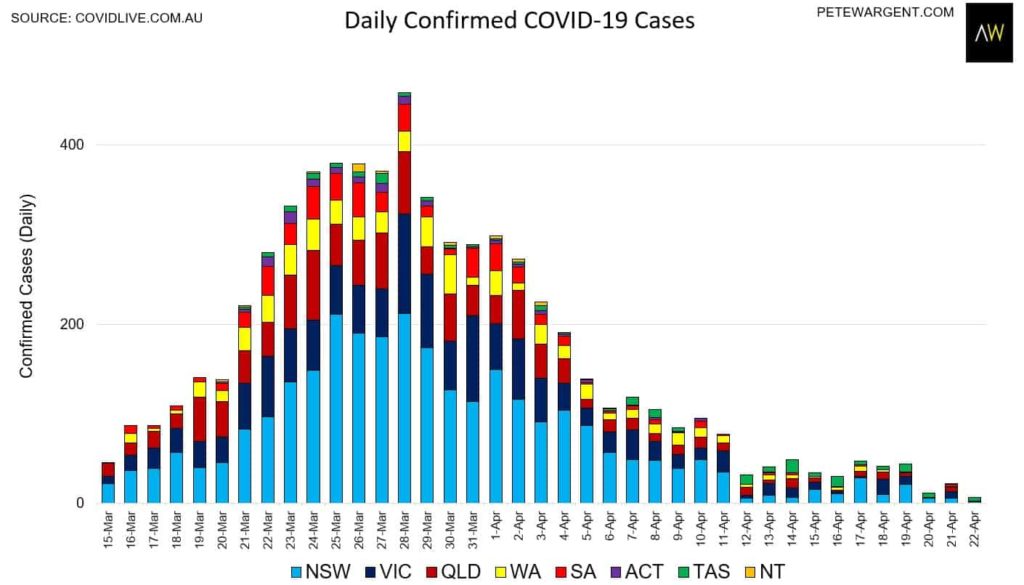

I’m also pleased that the strict social measures to contain the spread of coronavirus are working extremely well. New cases have been falling nearly every day!

The following charts are very encouraging…

Of course, we’ll be able to look back later and see the most ‘optimal’ way this could’ve been handled. But personally, I’m thankful for the actions I’ve seen to date, and very glad to live in Australia.

Once again, it seems like we’re living up to our name as the lucky country, as we’re arguably one of the safest places in the world during a global pandemic…

It’s also great to see the world’s doctors and scientists coming together to fight a common enemy. Sharing data and information will surely lead to a vaccine sooner than it otherwise would.

Even just seeing stories of people helping each other with selfless acts. Like restaurants and caterers making and delivering food supplies to the elderly. Cafes giving free coffee and services to healthcare workers.

It’s great to see these stories and get a break from other tales of stress and selfishness. It even makes you think, maybe humans don’t suck after all? 😉

I’m not trying to downplay what’s happening out there. Things are pretty crappy for lots of Aussies right now.

But there’s also reasons to be grateful and to see the positives around us. We can take this as an opportunity to enjoy a slower-paced, more meaningful way of life.

Once we get used to these changes, we may even realise we can live a perfectly happy life with less spending and busyness than many assume. I certainly hope that’s the case.

What do you think? Will society and attitudes change as a result of the coronavirus? Share your thoughts in the comments below…

P.S. Thanks to everyone for your support and positive wishes on the upcoming podcast launch. I really appreciate it!

Superb.

A very sensible post.

Thank You. ????

Inspirational Dave. ????????

Great article, thanks, and that video is gold!

There are A LOT of economists and analysts and commentators right now predicting recessions, depressions, years to recover, L-shaped recovery, etc etc.

Here’s my prediction.

Our number of cases is dwindling fast. Pretty soon restrictions will start easing, first locally, then at state level, and then nationally. And as soon as they get the all-clear, people are going to go nuts! All that pent-up desire to go shopping, visit friends, eat out, go to cafes, go to the movies, renovate the house, buy a new house, go on holiday etc etc etc. Businesses will be faced with a massive increase in demand and be hiring like crazy. I personally think the economy is going to BOOM!

Haha glad you enjoyed it!

Interesting comment. What you’re saying does seem likely in terms of huge demand once people can afford to spend again, especially with mortgage rates much lower than before.

But the timing and strength of the economic rebound is hard (impossible?) to predict as we can’t say when all those stars will align once again 🙂

Thanks Dave, I’ve really enjoyed your posts since I discovered your website by accident late last year. Thanks for all of your no nonsense and realistic insights.

Awesome, thanks very much Peter!

Thanks for the positivity!

Great article. I have felt a bit guilty as I have been lucky work wise and am enjoying all the mentioned benefits.

Hi Jen, me too.

Dave, awesome article, really enjoy your perspective on life in general, and especially at this difficult time.

Thanks, I really appreciate it 🙂

Excellent … great perspective, thank you.

Nice one, Dave!

Seeing you holding up your mortgage payments a bit to invest makes me wonder what are your thoughts on making use of the COVID-19 early release of super to have access to those 10k and invest in shares?

My wife was made redundant and is eligible for it.

Thanks mate!

Depends on the tax situation which applies in your household plus this from another site:

“unless used wisely it could mean a person who, for whatever reason, withdrew $20k in the next few months has factored in and is OK with forgoing a possible $175k (30 years @ 7.5%) before taxes and inflation.”

I should clarify my previous post in that it was made with a view of taking a short-term position may have adverse long-term consequences.

This should be weighed up before taking any action tempting though it may be.

Obviously there are issues as SatayKing has mentioned, including tax and that it may get wasted. But in general, for a disciplined person, it comes down to how badly you want to access that cash now vs waiting until say 65. For us, we’re not taking it out as we don’t really need it. But I would think about it if we were still on the road to retirement and eligible, for the simple reason of control/access.

Great article Dave. Your positive comments on the current ‘not good’ situation will hopefully give others an improved perspective.

Thanks Dave, another gem!

I had to duck to Harvey Norman on the weekend (why is it open, by the way?) and there was no possible way for social distancing to happen. There were hundreds of people there, which I found interesting… the demand for consumption might not be as “pent up” as we think once the restrictions are reduced / released.

Another interesting thing… in Australia, (so far) three people under the age of 60 have died from the virus. No idea what their underlying health conditions were, if any, but I think it’s clear the possible perils of the virus have been over-stated. Purely by numbers, people in that age group are 25 times more likely to die in a car accident than from the virus (average in Australia in 2019 was 75 per month). Like you, I genuinely wonder if statistical information like this will sink in and result in long-term behavioural change?

Wow crazy! What the hell is everyone doing? Buying games and gadgets perhaps?

Hmm on the change stuff, a big part of me is pretty cynical about people’s ability to change and/or ‘do the right thing’, so I would only expect change at the margin, rather than widespread adoption of a new way of life. Kind of like the FIRE movement. It’s amazing that people are joining us and I like to think I’m helping the cause, but I don’t expect the majority of people to be coming around to our way of living/spending/investing anytime soon lol.

Hi Chris

I agree with you that the younger populations are at less risk of dying from CoViD-19. However, the same group are the prime source of transmission of the virus. So until there is a vaccine available, some form of social distancing (and hand-washing!) will have to remain in place.

Totally agree, though not sure waiting for a vaccine is realistic. Neither is herd immunity, so agree that the sustainable, effective middle ground measures need to remain in place.

G’day Dave,

Thanks for the article. Refreshing read. What really reverberated in it for me was the importance of structure. Working from home really is a taste of a mini retirement, and I for one am loving it. I’ve been able to dedicate a lot of my time to writing and developing great articles for the blog, and catching up on the backlog of SMA articles I have had on my to do list (as well as Pat the shufflers, Aussie Firebug and Mr Money Mustaches). By the way, I am excited for the release of Your and Pats upcoming Podcast!

But I have found without setting some boundaries and structure (such as thou shalt not drink beer prior to 12 noon) that I kind of fall in a heap. By setting a good mini schedule of what I want to do, I keep my days full and fall into bed exhausted at night. A focus on quality exercise has really helped in this regard to, and I am just trying to set lots of small incremental good habits which then spiral up in a positive manner, almost like a compound interest!

I agree that the sharemarket is not permanently damaged. I think there are still solid foundations in the majority of companies, and whilst some will go bust and some will take their place, as a whole the human race is not going to fall in a heap and we will continue our awesome trend of improving quality of life and as such the index will continue to rise. I just want to be able to earn enough dividends along the way to cover my cost of living.

As you mention, simple pleasures and being grateful are a big part of how I am keeping a positive mindset at the moment. I get a safe place to live, I get awesome food, and I get to have a stable paycheck are three massive ones for me at the moment. Shang from SavemyCents.com actually introduced me to the concept of #IGETTO which is her way of practicing grattitude – she writes her #IGETTO statements everyday as a form of positive affirmation.

Anyway mate, I better get back to my ‘schedule’ as its a cracker of a day outside and well, my neighbours dog ain’t gonna walk itself.

Cheers,

Capt. FI

Cheers Captain. Love that gratitude list 🙂

Thanks for sharing your thoughts and experience from the taste of early retirement, great to hear it’s going well. Structure is a huge one for me too – super important!

Another positive is that Australia has managed to have less total cases per million people and less deaths per million people than many, many countries including the USA, UK and even NZ. The economic impacts can’t yet be fully known, but it is highly encouraging to see such a great health outcome. For once it’s great to be below average!

Source: https://www.worldometers.info/coronavirus/

Absolutely JD, we’ve done really well, whether it’s partly due to luck or not – who really cares?! Fantastic outcome nevertheless compared to many other places 🙂

Love the positivity, mate! Well done! It’s definitely there, we just have to find it.

Hi Dave

I’ve recently bought VAP.ASX today, Vanguard Australian Property Securities Index (VAP), what a great entry point buying at 2014 prices! A great set and forget investment for me. I’ve set up the DRP and will review in 15 years. I believe you mentions this ETF on one of your posts.

It’s share price was around $90 just a few months ago and have now dropped because of the Coronavirus.

Property REITS were a bit overvalued a few months back but now are a good buy imo.

Great post, we wrote a similar post last week focusing on the positives as well if you’re interested in checking it out

https://modernfimily.com/the-positives-that-can-come-from-coronavirus/