Start Here

Close Menu

November 23, 2017

Welcome to a new series, called LIC reviews!

Since I bang on about LICs, I thought it best that I go through a few and review them for you guys. And in doing so, explain my thinking and why I find them attractive for our portfolio.

So from time to time, I’ll review various Listed Investment Companies. These are often LICs I own personally. And I’m happy to rely on these vehicles to give us the income we require, to sustain our financial independence.

Let’s get started…

History

AFIC was established around 90 years ago, back in 1928. Today, they’re the largest Listed Investment Company on the Aussie sharemarket.

Investors can buy shares in AFIC just like any other share, through their stockbroker.

AFIC now manages a portfolio of around $7 billion worth of Aussie shares. They have invested through many different cycles and varying market conditions.

Being long-term focused, the company will look past short-term noise about the markets or it’s investments. Instead, AFIC focuses on the long-term potential of the companies they invest in. And the ability of those investments to provide increased earnings and dividends in the years ahead.

Here we go, straight from their website…

Our primary goals are:

— to pay dividends which, over time, grow faster than the rate of inflation; and

— to provide attractive total returns over the medium to long term.

Sounds pretty good to me. In fact, that’s exactly what we desire for our own portfolio!

As a result, this is why these LICs sit so well with me. Our goals are the same. So we’re invested accordingly.

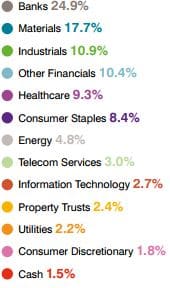

AFIC has a large diversified portfolio of shares – around 100 different companies.

Since they have such a large amount of money to manage, the portfolio is understandably weighted towards the largest companies on the ASX.

Here’s the breakdown of the portfolio by sector:

A good mix of investments there.

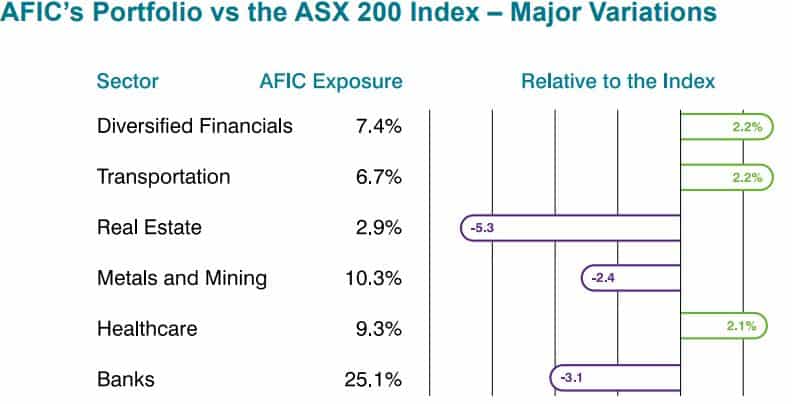

Because of this weighting towards large companies, the portfolio is similar to the Aussie market index. But although it’s similar to the ASX 200, there are still some notable differences. See below…

Also, you can see a list of their largest holdings here.

So hopefully, you’ve now got a sense of how AFIC is invested. One point I’d like to make – they manage the portfolio with their main objective in mind (a growing income stream).

Rather than replicating the index or buying what’s popular, they invest for the long-term income stream.

Most importantly, their dividend focus keeps them out of trouble when the next fad comes up. Whether it’s lithium stocks, marijuana stocks, or whatever. AFIC will just keep looking for profitable businesses. And those that can grow earnings and dividends over time.

As a result, the portfolio is satisfyingly boring!

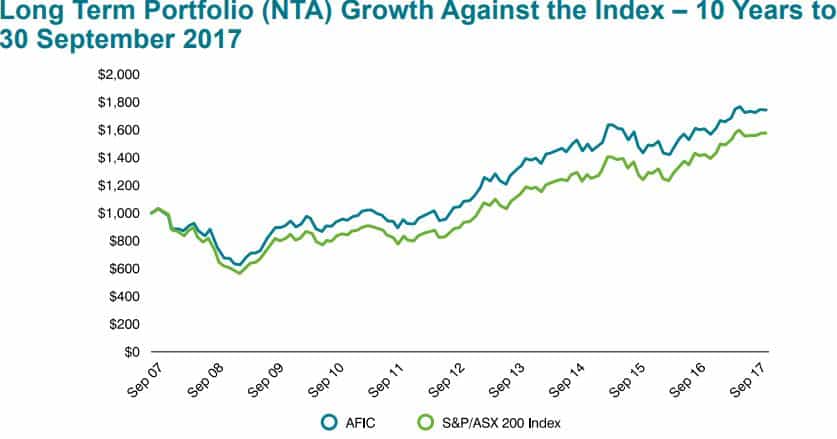

The last 10 years have been rough for Aussie shares. Maybe you’ve seen the headlines screaming “zero returns for a decade!”

While this is true in terms of share price, it (stupidly) ignores dividends.

Truthfully, the starting point of 10 years ago is a little unfair. For one thing, we had that thing called the GFC!

So if one looks at 5 year or 15 year returns, they look much more normal. Give it 18 months or so, and then the 10 year returns will look incredible!

Anyway, let’s look how AFIC has fared over the last 10 years, including dividends, compared to the ASX 200…

So we can see that AFIC has managed to outperform the index nicely over the last 10 years.

Rather than getting zero returns, you would have earned close to an 80% return, over 10 years. And mind you, this is assuming you invested at the worst possible time (right before the GFC).

Being dividend investors, our focus is on the growing income stream. It’s just a bonus if our companies manage to outperform the index – it’s not the main goal.

Speaking of growing income…

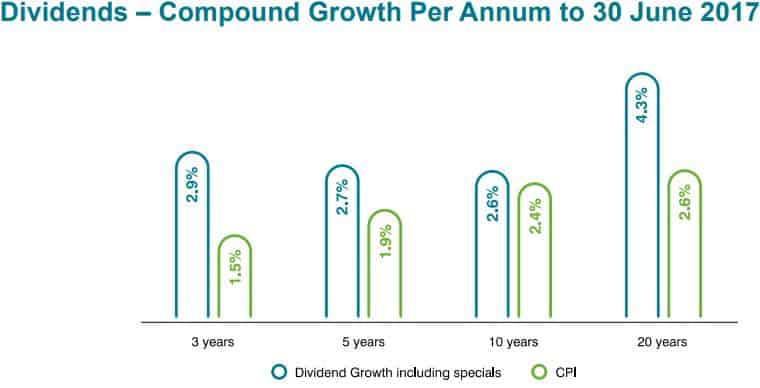

Now, let’s look at whether AFIC has met it’s objective of providing growing dividends to shareholders.

Importantly, their goal is to grow dividends faster than inflation (CPI). So let’s check that…

Seems like they’ve solidly ticked this box. And over all periods, including the GFC.

This is an important point. While the GFC must have been painful for many, it wasn’t a disaster for everyone. Many LICs keep some profits in reserve, so they can smooth dividends to shareholders over time.

Because times aren’t always good and companies cut their dividends, the LICs will use their profit reserve to make sure their shareholders receive a relatively steady dividend, where possible.

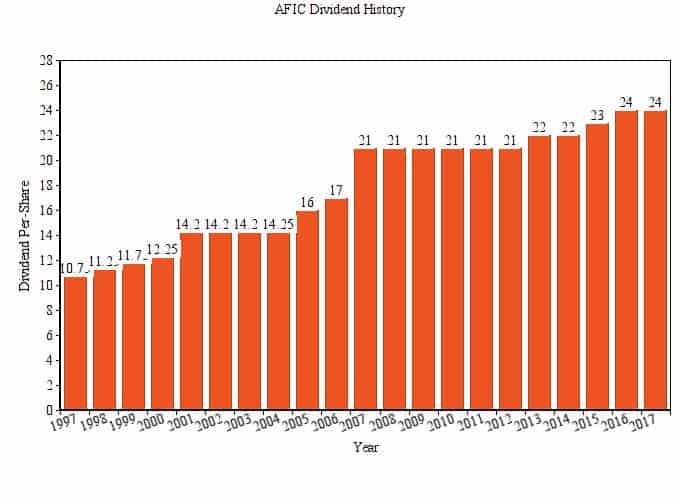

Here’s their dividend history in chart form…

As we can see, AFIC was one of the companies who kept their dividend stable during the GFC.

So retirees would have received the same level of dividends, even though AFIC received less dividends from their portfolio.

As a shareholder, this is very comforting. It’s quite clear, dividend smoothing is a great feature of LICs.

And as AFIC receives higher dividends from it’s portfolio over the years, they regularly reward shareholders with a pay-rise.

By the way, I created a spreadsheet to keep tabs on my annual dividend income to help plan my finances and watch my progress. Get it below.

AFIC is also one of the lowest-cost ways to invest in Aussie shares.

Its Management Expense Ratio (MER) is 0.14% In other words, very, very low. AFIC also charge no performance fees. Also, they’re internally managed – meaning no fees are going to an outside manager.

The MER is essentially the costs of managing the company. Things like staff, office rent, equipment etc. It’s an important point. Because as their portfolio increases, their costs stay roughly the same. As a result, the MER tends to drop.

Only this year, their expense ratio dropped from 0.16%, to 0.14%. Essentially, the internal management structure means the savings go to shareholders.

Overall, AFIC is a very low-cost way to access a managed portfolio of Aussie shares.

I really like AFIC’s long history, and track record of dividend growth. Also, it’s large diversified portfolio – around 100 companies from many different sectors.

Since they’ve shown good performance vs the index, that’s also pleasing. But it’s their objective that I find the most appealing:

To pay dividends which grow faster than inflation, and achieve attractive total returns over the medium to long term.

Living solely on investments, it’s critical that our income is relatively stable and keeps up with inflation over the years. So I’m comforted by the fact that increasing dividends is AFIC’s goal too.

For accumulators in higher tax-brackets, they also offer a Bonus Share Plan, or Dividend Substitution Share Plan. This is where you receive bonus shares instead of dividends, and pay no tax. It’s all ATO approved, I swear!

Essentially, this caps the tax rate at 30% (company has paid tax already, you pay none). If I was starting my journey today, and in a high tax-bracket, I’d definitely look to harness this benefit.

In fact, I wrote a lengthy post about using these plans and the tax efficiency of dividends in general here: The Surprising Tax Efficiency of Dividend Investing.

Also, given AFIC is a long-term investment company, the ATO has also allowed them to pass on the Capital Gains Tax discount to shareholders. So every now and then your dividend will come with franking credits, plus a special Capital Gains Tax discount, tax deduction. Win, win!

If anything, I would prefer AFIC had less exposure to resources companies. Primarily, because of the less reliable dividend streams from resource companies generally, given their profits are volatile.

But since they tend to focus on only the largest and strongest dividend-paying resource companies, it may not be a problem.

Also, their portfolio size may become tricky. With $7 billion, it may be hard to make meaningful new investments, without buying large stakes in small companies.

And given their long term ownership of some stocks, there would likely be a large tax bill triggered if they sold. There’s a chance this makes them hold on to companies with less-than-bright futures for too long.

Admittedly, the portfolio is probably still a little heavy on financial shares. But to be fair, they’ve been some of the most profitable companies in Australia. And many financial companies pay great dividends, so for an income investor, they’re hard to ignore.

Overall, I’m a fan of AFIC.

To me, they’re a great low-fuss option for investing in Australian shares. With a portfolio of 100 companies, our dividend income is sourced from many different businesses.

I think that AFIC should have good performance over the longer term. And I’m confident, in 30 years time they’ll be paying much higher dividends to shareholders.

Finally, I’m putting my money where my mouth is – I’ve been buying AFIC shares for our own portfolio.

Currently, it’s on a dividend yield of 4%. Or 5.7% gross yield (including franking credits). That’s a pretty attractive starting point. And an income which should grow steadily over the years.

A low-cost, long-term, dividend-focused and tax-efficient investment vehicle…what’s not to like!

Did you enjoy this LIC review? You can find more like this on the LIC reviews page, which includes my thoughts on Argo, Milton and others.

WANT PRACTICAL NO BS FINANCE CONTENT EVERY WEEK?

Join thousands of readers and subscribe to the Strong Money Newsletter below.

Also a huge fan of AFIC here. Look forward to your future LIC reviews!

Good stuff Jack Thanks for reading mate!

Thanks for reading mate!

Woohoo. LICs, now you’re talking young fella.

Note that AFI has around 20% more franking than the Index so in your Accumulation (includes dividends) chart above if franking was added the outperformance would be better again. Note also the index doesn’t include fees which even index ETFs charge investors. All this is no doubt nothing new to you.

AFI could be described as being a mostly ASX Top 50 LIC. So what’s the perfect match for AFI? Drum roll …… . MIR, run by the same mob but focuses on the ASX Ex-50 sector of the market. But I’ll wait till your review of MIR before discussing that further.

As for AFI those keen enough can get additional information to the above excellent review from the following Research Report:

https://dpsi7pmz5b6vt.cloudfront.net/uploads/ckeditor/picture/1290/AFI_FINAL.pdf

Unlike a number of the new breed LICs that have listed in recent years old school LICs like AFI certainly won’t cause you any heartburn.

Keep up the great work.

Cheers

Haha, thought I’d get a comment out of you!

Funny you say that, actually I think it is including franking – they show in that same report that total franked return has been 5.7% over 10 years. That works out to around 75% or so total return over 10 years, which is exactly what the chart shows. So I did write initially saying it’s not including franking…but it appears it is!

But you’re right the index is not taking fees into account. I don’t want to bag the index too much..the bogleheads will be after me!

Be patient mate…I’ll get around to the others

I plan to outline quite a few of them. And then discuss how one might bring them together. Although, I’m worried it will take away from the simplicity of it all.

Thanks for the extra report, and your comments as always Austing. Or is it just Flash these days?

No longer The Flash unfortunately. The wife found out so I’ve had to cease flashing.

Just a note, if AFICs returns are including franking is it fair to compare it to the ASX return which typically doesn’t include the effects of franking in the total return index? Or is that included in the chart comparing the two above?

Hey Pat.

The figures are from the most recent presentation here

The returns are both including franking – 5.7% p.a. for AFIC, vs 4.6% p.a. index return. Note – index return is before fees, which would increase the gap. The older LICs are usually quite open and honest about total performance, unlike some of the newer ones.

Even if total return including franking was lower than index – it’s the relatively predictable and growing income stream I’m after.

I love how within Super you get a 15% tax rebate on franking. Outside of Super the 100% franking is such a boon especially once retired. I invest in AFIC both in and outside of Super

It’s definitely a sweet setup. Dividends in Australia with the franking credits, make for some incredible cashflow generation. A couple can receive 40k of dividends tax-free in early retirement, due to the tax-free threshold etc – a wonderful scenario.

Great review! Really looking forward to the next one! I’m a happy holder of both AFI and MIR. Not a mention of NTA anywhere (well done)!!

Thanks mate. You might guess I did that on purpose. It tends to confuse people and with these older LICs, it’s rarely an issue – they’re mostly trading around NTA.

Simple is best as you know!

Is it better to try to buy it when it is trading at less than NTA ? Or does it never trade at less than NTA ?

Well it’s better to buy something at a discount for sure. Given it’s a popular LIC, it doesn’t trade at a discount too often, but sometimes. You can find the history of discounts and premiums it’s traded at (many other LICs too) here at the top of the page.

Unwillingness, just for you:

NNNNNNN TTTTTTTTT AAAAAAAA????.

Shame that these franking and other aspects don’t apply if you’re overseas… which is logic but a shame really, hence me looking and turning US shares

Saying this, all my aussie shares are ARG and AFIC too!

Yeah it is a shame for Aussies who wish to retire overseas. Although as you know, it makes sense to invest in overseas shares (more-so) if one is going to live outside Oz.

Argo is another great LIC, on the list to review

Yes but fully franked dividends are tax free and so are capital gains for overseas retirees (non resident for tax).

Look forward to more of these…..

Rick

Cheers Rick! Thanks for reading.

Fantastic article. Keep them coming.

Thanks Jaik2012

I’m a believer in AFIC – 20% of my portfolio is with AFIC. I also like how transparent their website is with all the facts and figures that separate growth from dividend return.

Thanks for commenting Phil.

Yeah, it’s nice the older LICs are honest and transparent with their approach and performance, in an industry which is not generally known for it’s trustworthiness!

Thank you, thank you. 2018 is going to be the year when I start to learn about LICs. Articles like this which are easy to read and come from someone with direct experience are so helpful. Looking forward to more.

Thank you for reading it!

I’ll try my best to keep it simple and explain what various LICs are all about

I really enjoy the blog article.Really looking forward to read more. Fantastic.

Thanks! Glad you enjoyed it

Umm, sorry to contradict but AFI is dead boring and has poor performance to match.

A 7 billion $ market cap means it is too cumbersome and can’t take meaningful positions in

growing companies. It holds on to underperformers like Telstra forever just because of their index weighting.

Here is the 5 year total performance figures( % p.a. ) to end of Nov 2017 comparing AFI to the ASX200 and numerous other well known established LICs.

ASX 200 10.5% p.a

AFI 9.05 % p.a

AUI 11.5%

DUI 12.6%

WHF 14.3%

WAM 15%

WAX 18.8%

clearly there are numerous other LICs as listed above which have outperformed AFI over the past 5 years

and AFI has not even kept up with the ASX200.

Thanks for your comment Carlos!

You’re right that AFI is boring, but I’m not sure that ‘exciting’ is a good aim for our investments. They will hold on to underperforming companies for probably too long, due to large capital gains owing – low turnover can be good and bad, which I stated as an issue in the article. Their size is an issue, which I noted.

Also, I think 5 years is just not long enough to go on to make a judgement, which is why I used the 10 year figures, showing they’ve comfortably outperformed the ASX 200. Any manager can perform well for 5 years. And indeed, they each have their time in the sun, and show varying levels of performance each 5 years.

It looks like you’re using Total Shareholder Returns (TSR), which I feel is a little inaccurate when it comes to LICs. What we really want to measure is the performance of the portfolio after tax and fees(NTA) since it gives a better measurement for how well management have invested. Then we can include franking credits too (if we wish) for a clearer picture. I don’t like using TSR – which is share price plus dividends, because when we look at WAM and WAX, they have grown in popularity massively over the last few years, and now trade at a premium – making their TSR look incredible. But this isn’t due to the managers performance, but the popularity of the LIC – investors have bidded up the share prices to large premiums. You can find the true NTA performance on this page here. under Indicative NTA’s (franking isn’t included though). If you look here, you’ll see that over the longer term, the older LICs have performed very similar to one another, with the WAM,WAX funds doing a bit better. We hold both those LICs ourselves.

To be clear, I wasn’t saying AFI is the best LIC. I was saying I like it, own it and think it’s sensible investment for the reasons provided.

Comfortably outperform the index over 10 years?? Not true.

As per their own website, over 10yrs the AFI share price + dividends has returned 4.1% per annum. Versus 3.7% for XAOAI.

AFI is no better than an index fund, and at times such as the past 5 yrs can’t even keep pace with the index.

There are plenty of managed funds and LICs that have done far better than 4% pa over the past 10 years. Have a look at WAM for instance. That is why AFI is very overrated. By saying it was boring I meant it is an underperformed.

I agreed with many of your points and detailed my reason behind disagreeing with other points. I already put up the chart, and the report, where they show NTA returns plus franking over the 10 year period. They did outperform the market comfortably. I’ve already given the figures from the report which include franking (as it should) – 5.7% p.a. for AFIC vs 4.6% p.a. index. I would have thought 1% p.a. was comfortable outperformance?

We may be talking about different data – I don’t agree with using share price to measure return – the company has little control over share price, and it doesn’t reflect the performance of their investments.

It’s becoming very similar to the index yes, that’s makes outperformance harder. Yes, there are better performing LICs over 10 years, I agreed with you there. And read the documents on the link I sent you – it makes net returns more clear.

It’s popular sure. But I’m not aware of anyone suggesting it’s going to have incredible performance anytime soon. So I’m not sure who is over-rating it? Since it trades around the value of it’s NTA, you could say the market rates it correctly. If it was very over-rated, it would trade at a large premium (it doesn’t).

To use your example, if anything WAM is becoming overrated, since it currently trades at over a 20% premium (meaning it’s rated extremely highly). You could say despite only outperforming the older LICs by few % p.a. over the last 5 years (your chosen measurement), it doesn’t deserve a 20+% premium. I’m betting you’re still looking at share price though, which can skew the results. See this document for NTA returns. I’m not knocking WAM. I like Wilson as a manager and hold WAM and WAX. Just trying to put it in context.

Again, I reviewed it because I’m happy to hold it. Doesn’t mean you have to. I think of it as similar to the index, but with a dividend focus, which suits us nicely as early retirees. Sometimes it’s not always about performance – which I also stated in the article. For us it’s about a reliable and growing income stream. No dividend cut during the GFC would have made long-term shareholders very happy and loyal (some of which have already commented here).

Personally I use WLE ( WAM Leaders) for my large cap LIC exposure.

It’s still trading slightly below NTA.

Given Wilson funds long term outstanding track record, I expect it to beat the likes of AFI, Argo and Milton hands down.

Thanks for sharing Carlos. I’m watching WLE too. But I want to see good after-fee outperformance in large caps, before I pay Wilson those hefty fees

Outperformance is usually harder in large caps, due to the amount of research and following in this area of the market and fees make it harder again. Will be very interesting to see how they go!

I also took a large chunk of WMI ( WAM Microcap) at IPO last year. Early days yet, but performance so far has been fantastic, and means I avoided the hefty premium to NTA with WAM and WAX.

WLE and WMI make an excellent pair and I’ll keep them for many years if not decades.

The other LIC I’m keen on is Forager (FOR.). Steve Johnson is an outstanding value investor and his fund has returned 18% per annum for the past 5 yrs if you include the years spent as an unlisted fund. But I’m waiting for the double digit premium to NTA to hopefully shrink.

Definitely good performance so far. I watch with interest. I like Steve Johnson, very switched on guy and not fee greedy – his fund has done wonderfully! It’s actually a LIT (trust structure) if I remember right, meaning no dividend smoothing, all capital gains paid out. Being that we’re income focused, it’s not really for us personally, but a great fund nevertheless.

Actually make that 19.87% per annum over the last 5 yrs for Forager Australian fund, after all fees.

No wonder the LIC is trading at premium to NTA.

Thanks for a great site and great, great information Strong Money Australia. I have seen the stuff on Bogleheads but this is great to see information about LIC’s and an Australian site.

I have been investing since 1999 and haven’t really looked at LIC’s in Australia. I wasn’t aware that the AFIC MER was 0.14, that is amazing that it is about as low as Vanguard Australian index ETF (0.14 – VAS). I might put a small allocation in AFIC and try it out.

I think the income sounds good but I don’t know if the dividend advantage outweighs the mildly discretionary nature of their investing. It sounds like it is conservative and low cost and a 50 plus year track record is very reassuring. Still I am not sure if I like firm specific or management specific risk and that would limit my allocation to it. It sounds better and cheaper than the equivalent Vanguard product VHY (MER 0.25) ?

With AFIC, do you know if it has it traded at below NTA in the the last decade, and to what discount level ?

Thanks again for your site and great information.

Thanks for the kind words.

The low fee is certainly competitive and shareholder friendly. You’re right about management risk. That’s why many investors will own multiple LICs to spread the risk around – often owning VAS too.

I see it as very different to VHY. For a start VHY only holds high yield companies. And only around 40 holdings. Whereas AFIC holds around 100 companies, some of which will have low yields but should produce good dividend growth. I much prefer AFIC for a more well-rounded investment. See my other reply for premium/discount history. Hope that helps!

If you have a look at their website http://WWW.AFIC.COM.AU

You will find a graph showing that the shareprice oscillates between premium to discount to NTA. Some years at 5 to 7% discount.

I would never buy what is almost an index fund at a premium to NTA.

Sorry made a mistake, the website is http://WWW.AFI.COM.AU

Good find Carlos! The picture version is much easier to follow and shows the cycles in premium/discount nicely. Here’s the page http://www.afi.com.au/How-We-Invest/shareprice-NTA-chart.aspx

Interesting that it was trading at a premium to NTA from 2008-2010, and particularly during the worst part of the GFC but not as not in 2011-2012 (I wonder why) ?

Thanks for your comment!

It is interesting. Hard to interpret why. In 2011-12 looks as though everything got sold off.

But from what I understand, it’s likely to have traded at a premium during the crash simply because the market was dropping so fast. So I’ve noticed the price of the old LICs tends to move around a lot slower than the market. When the market is rising quickly, they will often get left behind and trade at a discount as the market cruises higher.

These things tend to move in cycles and even out over the long term. But it’s interesting to watch and can make for some good opportunities!

AFIC are part of my portfolio, 4% isnt going to make me a millionaire but they are about as safe as it gets along with their counterparts like ARG, WHF….slow and easy wins the race sometimes. Or you can sit back and watch your capital burn with others promising 11.4%..not mentioning names but you know who I mean…

Thanks for your comment Mark!

10 years ago I would scoff at the term ‘slow and steady’. But now I think it’s a very wise way to approach investing.

Haha yes, there’s a couple of yield traps out there!

as safe as it gets ??? gee whiz….

have a look how AFI went during the GFC.

they basically are very similar to an index fund.

if AFI are safe , then so is index investing. yeah, sure….

and AFI NTA growth + dividends hasn’t even kept up the XAOI index over the past 1, 3, and 5 year periods.

over the past 10 years, total shareholder return 4.5% per annum

yep, super safe and gonna get rich slooooooooooowly. EXTREMELY slowly, if ever.

Carlos, we’ve already gone over this! The NTA growth including dividends + franking (which is more accurate and fair for to measure any LIC) has been 5.7%, outperforming the index. The shorter timeframes are less important, anything can happen over a few years. Indeed, I’m fine with them underperforming over certian periods, because our goal is a stable and rising dividend stream. I prefer they didn’t invest in small resource companies and the other stuff that’s been outperforming lately.

10 year return is dragged downwards by that little thing called the GFC. Same as most returns from the ASX. It’s just a timing issue. In 18 months, the 10 year returns will look great as the GFC will no longer fall in the period. It’s important to recognise the reasons behind the data.

Check the most recent half-year report on page 7 here.

See what’s happening? As the GFC slowly drops out of the 10 year period, the 10 year returns look better. Now it shows 6.6% p.a. Big difference for only a couple months of data. The point is it’s misleading and tells us nothing of the future either.

Are you familiar with market crashes?

What generally happens is everything gets the crap beaten out of it, regardless of quality. There’s so much panic that often many people just want to get out of stocks altogether. The LICs actually held up better than the index during the GFC, and the income stream was much more stable too. Take a look at this chart a forum member put up over here (it’s down the page a bit, post #157)

So you’re not a fan of indexing, you’re not a fan of old LICs, what do you like? You seem to just look at recent performance as the best indicator. Studies have shown it’s a terrible indicator of future performance.

Hello Everyone .

A monkey throwing darts at a newspaper finance page could have replicated the index returns since the GFC ; hence once should take a survey on a longer term time scale such as , say , twenty years in order to make truer [ no such word can exist ] comparison re AFI versus the rest .

LIC ON , Ramon .

Carlos, Mark Freeman didnt send you a Christmas card? so have a anti AFIC position?. You probably dont like the banks either right?

I want AFIC for its dividends and franking credits as I run an income portfolio, I dont expect it to be the next Bitcoin in terms of growth just give me growing income. GFC?…yep its called riding the bumps of investing, get used to if you buy Forager with SJ’s love for McMahon Holdings and all things contrarian….though I did read he has 26% in cash for FOR so he must be scratching his head where to invest…

Think I’ll stick with my Wilson LIC’s….Forager is a tad too boutique for me….

I am just starting to research into living off dividends and very thankful I came across this site. Really looking forward to you reviewing the other LIC’s and then putting it together to show how they could work in your portfolio. That has been one of my questions as many of the LICs seem to cover the same stocks, so very interested to see how they fit into the one portfolio?

Thanks for stopping by Jason!

I think living off dividends is a wonderful strategy which doesn’t get much mention in the early retirement community.

You put forward a good idea, and that’s the plan actually. Review a broad range and then show how they might fit in a portfolio. The large old-school ones can be combined to spread risk between managers, even though they’re similar. After that, it’s really dependant on how much diversification someone wants – mid/small caps/international/reits etc. So it’s tricky because of different personal comfort zones, but I hope to give a few examples

I would love to see a post showing how the various LICs could fit into a sensible portfolio. I have my own ideas but old love to see what you and other commenters have to say.

Bought some AFI today at 6.09. Hope it is the right entry point for a long term hold.

Nice job Ken. I’m sure AFIC will do just fine over the next 30 years. Kick back and enjoy the dividend stream.

Great site. I’ve been tracking my spending (up to 45% savings rate) and buying up LICs with my first purchase into AFIC.

Thanks Christopher and very nice work!

Hi Dave – you mentioned above that you use CMC as your online broker. Have a look at SelfWealth. I’ve been using the platform for over a year now (after leaving the Commsec gouge) and very happy with it. The brokerage is never higher than $9.50 regardless of the trade size. They also have a promo link for members where you and the new person get 5 free trades with a 30-day expiry.

Thanks for the recommendation Scott – I’ll take a look at them.

An interesting difference I just discovered with AFIC is the Dividend Share Subsitution Plan (DSSP). This can be used instead of the DRP. These are all clearly outlined on their informative website.

Just to make clear the differences:

DRP: dividends can be received as new shares at the given price possibly with a discount. The dividend is reported as a taxable income. Franking credits are received in addition. (So there will be an income tax discount accordingly – except of course if the proposed Labour changes ever eventuate.

DSSP: dividends are received as new shares in lieu of cash. The share price I believe is the same as the DRP price. Hoewever – from a tax perspective, this is NOT declared as taxable income. There is an ATO tax ruling on the website plus more indepth information. The other difference is that because a dividend is not paid, franking credits are not received by the shareholder.

So what does this mean. If you are on a higher marginal income tax rate ( >30%, though potentially less with company tax rate changes) then this seems to be a tax effective choice.

Assuming a marginal rate of 45%, through a DRP the effective tax rate is 15% (45% -30% franking credits. With the DSSP, the net tax is 0% , a 15% tax benefit. (ignoring medicare levy which probably adds another 2%) Even if you are on the 32.5% marginal rate, there is a small benefit of 2.5%

Presumably this means that if you are a 100% reinvestor and on a higher marginal tax rate than this is a winner.

I don’t see such a plan with any other LIC, and not that I think AFIC should be the only LIC you choose, but this is something that should be considered. Even if AFIC is boring

Thanks for the detailed info SJ! I did mention it in the review, but didn’t want to spend too much time on it.

It’s definitely an effective way for higher tax bracket accumulators to invest for financial independence. Simply switch it on when buying, then when you reach FI, switch it back to receiving income + franking.

There is actually another LIC which offers this. Whitefield, which is another old diversified LIC, been around for 90 years, pays stable and growing dividends. Info can be found here – Bonus Share Plan.

Haha boring in the best way possible

The DSSP is also a very good reinvestment technique for those who operate a family trust structure with minor beneficiaries. As minors are taxed on income (dividends) at the top marginal rate, the DSSP allows the distribution to be treated as capital thereby removing the taxing point on the Trustee. This outcome means the Trustee can effectively build a capital base for the children.

Thanks for that info Stephen. I’m low on knowledge with structuring, so this will surely be helpful for folks in a similar situation.

hi, only just discovered your site and not even sure how I got here. LOL Anyway, there seems to be a lot of material to read here so it will take a long time to get through it all. But anyway, on the subject of AFIC i may be asking a silly question here. On reading some of the info on AFIC you mention about fees?

I was under the assumption if i purchased shares eg through Comsec i only pay the brokerage fees? So not sure when you were saying fees, what you actually meant? Finally when going on the website of AFIC there is a NTA price and then you have the stock price. So when is it best to buy shares then?

Hi there, however you found the blog it’s great to have you here

Sorry for the confusion. There’s no fees you have to pay to AFIC directly – the fees I mention is merely the costs that AFIC incurs in managing the company. This is called the Management Expense Ratio (MER) and is a good way of measuring whether a LIC has high or low fees/costs. It’s important that we know that since lower costs generally equals more return for shareholders. Hope that helps!

Sorry for asking a question here that is not related to afic as i was not sure where to ask a new question.

Do you have anywhere on your website or links for a cheat excel sheet to keep records of buy and sell trades.

jdc

All good Joe – ask wherever you like!

I don’t use excel to record trades – I’m not much of a spreadsheet guy. I prefer to use Sharesight, which is far easier to use and can keep track of trades, dividends and performance and you can even run a tax report each year. It’s free up to 10 holdings which is the best part. There’s a link on my recommendations page for it. If you have more than 10 holdings, it’s no longer free but comes with extra features. If going this option, you can get 2 months free using my link (full disclosure: I’ll receive a small commission for the referral, at no extra cost to you). Hope that’s helpful!

Could you explain the share substitution plan and taxation a bit to me please? I’ve been reading the ruling from the AFIC website and it says something about how the bonus shares are valued like the original shares for capital gains purposes/are dated from the original shares for CGT purposes. I’m not sure how that works in terms of tax records keeping when you’re doing ongoing investing?

Like just as an example say I buy 100 shares, then get 4 bonus shares. Then the next year I buy another 100 shares and get 8 bonus shares. Am I supposed to allocate the 8 shares across the first and second lot of shares I bought when calculating capital gains?

I wrote a post around tax, dividends and using these plans in this post

Hope that helps.

Hi.

I’m a little confused with the DRP v’s DSSP. I’m in my mid 50’s…so if I was looking to buy into AFIC, and over time accumulate more AFIC shares…would I be better going down the DRP path, and then, once I want to “live off” the dividends (retirement), switch to DSSP…or, is it the other way around? I take on board that ones’ earning capacity comes into play, but I’m asking in a “generally speaking” term.

Thanks you.

Hi Martyn, when you want to live off dividends, you simply elect to stop whatever plan you were using (whether it’s DRP or DSSP). The money will simply get paid to your bank account at that point.

I explain a bit more how the DSSP works in this post which you might find helpful. High income earners are likely to choose this plan versus a regular dividend reinvestment plan (DRP) due to the special tax arrangement explained in that post. Cheers.

Hi Dave,

I recently started reading your blog, and it’s great. I’ve been DRPing in individual shares for a while now, but will move towards LICs and gradually out of most of the individual stocks.

Just a couple of questions about AFIC’s DSSP – if the yield is 4% and 5.7% with franking credits (I understand it’s a bit lower at the moment, but for argument’s sake I’ll use those numbers as they’re quoted elsewhere) – if the DSSP is only equivalent to a 4% payment, is it really fair to say it grows tax-free? If the DSSP grew/issued at 5.7% I’d happily say tax free, but at 4%, isn’t it more a case of ‘grows without any additional tax paid’?

Also, isn’t participating the DSSP a form of speculating on future tax policy? While I think franking credits are here to stay (even if Labor continues to push its opposition to the refunds as it did in the 2019 election), if the CGT discount were to be abolished (eg going back to indexation) or reduced (eg a discount of only 25%), doesn’t that mean that future tax liabilities will be higher for all taxpayers – even those at the lower end of the income spectrum – that sell shares that were accumulated through a DSSP?

I find the DSSP an interesting concept, but – like investment bonds – it’s just too hard to believe that the ATO will let structures pass that will disadvantage it unless it’s a macro govt policy like super.

Thanks & keep up the good work.

Thanks Ivan. Depends how you look at it I suppose. No out-of-pocket tax to pay is in a sense tax-free since the primary 4% dividend is untouched by taxed, but you can also argue it caps tax at 30%.

You raise a good point. Yes there is an additional risk with DSSP that capital gains tax policy changes in the future… though I guess it’s only slightly more of a risk than normal, given these plans are really for people to accumulate tax effectively and then live off the dividends later. It’s not for everyone, but some people weigh it up and decide it’s worth it (likely people paying 48% tax), as the yearly tax savings are worth the risk if convinced they won’t sell later and instead just live on the income later.

Good points, Dave. I’m not quite at the 47% tax rate, and when the threshold changes to $200k for 47% and the 37% tier gets abolished, there’ll be no extra tax to pay (unless the company rate is lowered), so I’ll just DRP it until I eventually reach 47%, and then switch to DSSP. Goals!

Hi Ivan,

The DSSP is really more for those of us in high tax brackets. Even if the CGT discount is abolished and we have to pay full tax on capital gains, for those of us currently in the 37 or 45% tax bracket, it’s a saving. After all, people who’re trying to FIRE aren’t necessarily aiming to draw down over 180,000 per year from their portfolio!

Also there are people like myself who are trying to accumulate with the aim of eventually retiring on dividends, without selling off the capital as much as possible. So the DSSP really does let it grow untaxed – and then when ready, the accumulated shares can be switched off DSSP to just receiving dividends!

Addendum – if the DSSP is only equivalent to a 4% payment, is it really fair to say it grows tax-free, as the company pays 30% tax on profits?

Just to be clear, AFIC pays nowhere near 30% tax on its income. Remember franking credits are being passed from the underlying companies (after they pay tax), onto AFIC, and then onto you. So the tax is paid at the top level, by the individual companies. AFIC only pays tax on any unfranked distributions and capital gains from managing the portfolio. From the fully franked dividends it receives (which is most of its income), it pays no tax, as the franking credit they earn is equal to the tax they would owe. Hope that makes sense.

Yes it does, I didn’t take this aspect into account. Thanks for clarifying.

Thanks Dave. I love the idea that you and Peter teach about LICs for growing income streams… but wonder if times have changed… eg. ARGO grew divs each year from 2014 (28c per share) to 2019 (33c) … but has since reduced to 28c in 2021. Whitefield seems to be the only LIC I’ve found that has managed its income to increase dividends each: 17c p share in 2014 to 20.5c in 2022. I know that this is only a 9 year time frame…. AFIC’s dividend per share has been fairly flat: 22c in 2014 to 24c in 2016… and stayed at 24c to the current year … except for a spike to 32c in 2019… which which might have been managed better to provide a growing dividend stream to today???

Hey Tom. The main lesson is that dividends and company profits can’t be expected to grow every single year. But on average and over time, that’s absolutely what happens, which tends to be a pretty nice source of cashflow. Things can fluctuate quite a bit as you might know due to economic booms/downturns etc. Aussie companies increased their dividends at a dramatic level during the 2000s, but in the last ten years not so much, so these things go in waves along with the prosperity of the times.

Sometimes the companies will also pay ‘special dividends’ which is what AFIC did in 2019 and accounts for that spike you mention and I believe came as a result of a one-off large cash payment from one of their investments being acquired. So the underlying profits of Aussie companies haven’t increased enough in the last few years to pay much higher dividends. That doesn’t change the long term investing outlook though or the idea of getting a decent income stream from shares which grows over time. It’s just not a straight line up as much as we’d like it to be

Hi Dave, was just wondering if your views on afic have changed much since this article was written?

It always seems to be way above Nta, and with no increase in dividends dosnt it kind of mean that they aren’t meeting their goals of paying dividends that keep ahead of inflation?

Hey Luke. Nothing fundamental has changed with AFIC, it’s broadly the same investment company it’s always been. It has traded above NTA for a lot of the time in fact (seems to be the most popular LIC perhaps given its size and because Barefoot used to mention it quite a bit). So in that sense, it definitely isn’t good value and I wouldn’t buy it way above NTA.

In terms of their goals, it’s true they haven’t been able to keep increasing that dividend as targeted. That’s mainly because they held their dividend steady when dividends were falling a few years ago. So it’s taken a while for the portfolio’s dividends to ‘catch up’ if that makes sense. Given the big drop in dividends over covid and the large recovery afterwards, AFIC holders got a smooth income the whole time. Dividends have jumped higher after covid so I wouldn’t be surprised to see AFIC increase the dividend in the next year or two (but obviously I have no idea, it’s up to them).

For me personally, I am less concerned with a ‘smooth’ income stream these days (probably due to our part time income) and am happy to accept more of the ups and downs in dividends from index funds. Hope that helps.

Yeah definitely makes sense thanks. Like you I’m starting to favour etfs over lics.

Great to have you back by the way

Thanks mate! Got lots of articles in the works, it’s hard to decide what to write first

I also forgot to say AFIC re-jigged the portfolio towards lower yielding/higher growth stocks (less banks etc) which had the effect of reducing their income now with the idea it will lead to greater growth in the future.